EXECUTIVE

banking & treasury

salary guide

2023

banking & treasury salary guide 2023

Author: Alan Bluett, Partner

Download the 2023 salary guideView all salary guidesOverview

Banking

Banking has been a tale of two cities for the last 12 months.

On one hand we have the unfortunate situation of long-established retail banks leaving the Irish market, namely Ulster Bank and KBC. On the other hand, we are seeing substantial growth within the remaining retail banks of AIB, Bank of Ireland and Permanent TSB.

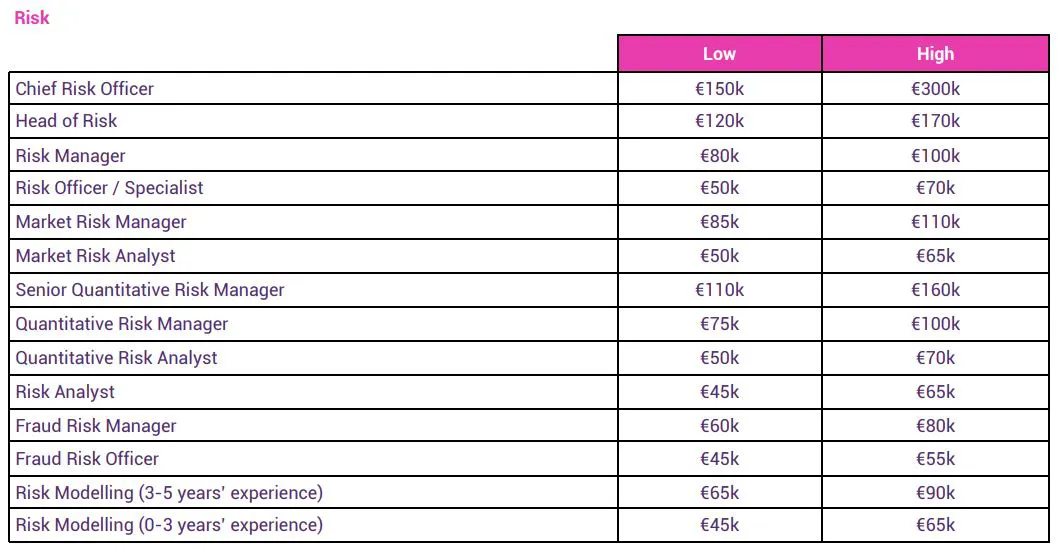

There’s no doubt that competition will be diminished within the Irish market as a result, especially impacting buyers of mortgages and loans. Despite this negativity, demand for staff remains robust at all levels, but with increased pressure to find experienced staff within IT, risk, compliance and governance.

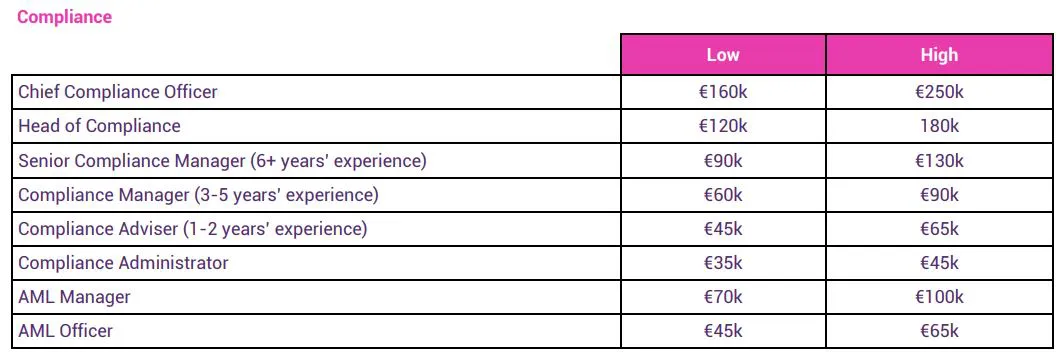

Risk and Compliance

The never-ending avalanche of new regulations being driven by the ECB, and by extension, the Irish Central Bank, has resulted in an insatiable appetite for experienced risk and compliance professionals in the Irish banking market. This demand for staff is being seen at all levels but it is especially acute from manager level upwards. At the senior end, employers prefer to hire risk and compliance specialist professionals with prior PCF approval from the central bank, thus mitigating the risk of new hires not being approved.

The one cloud on the horizon within this buoyant space is the impact that SEAR (Senior Executive Accountability Regime) will have. SEAR places rather onerous obligations on firms, and more specifically, on senior individuals within them, to set out clearly where responsibility and decision-making lies.

We have already seen a minority trend of candidates declining roles where they may be impacted by SEAR in the future. We suspect this trend will continue.

Treasury

Demand for treasury staff within domestic banking treasury continues to be anemic. Little risk is being taken and for all retail banks the primary focus remains net interest margin, especially as interest rates have risen quickly of late. The situation within international banks based in Ireland, with front office capability, is quite different. We have seen an increase in the level of risk taken in these operations and a corresponding increase in demand for experienced front office staff. This has been driven primarily due to Brexit and we would anticipate that this trend will continue in the coming years.

Technology tends to be the fore in all these treasury operations, where circa 50% of staff being hired are technologists.

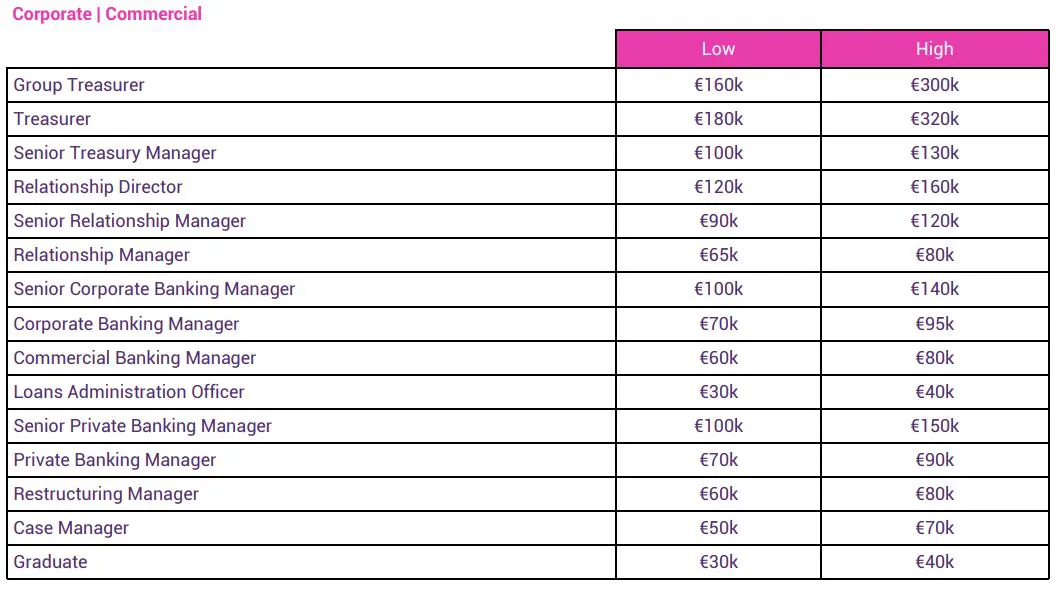

Corporate Treasury

Recruitment within corporate treasury in Ireland was extremely buoyant throughout 2022 and this was across multinational treasury centres, shared service centres and within traditional Irish plcs. There was some uptick in staff turnover as a rebound to the reduction in turnover during 2020 and early 2021 as a result of Covid. In addition to this, many treasuries expanded and needed additional headcount, while demand for staff was also higher due to the opening of a number of new treasury operations in Ireland.

Demand has been heaviest at Treasury Analyst level up to Treasury Manager, with only sporadic vacancies at the Assistant Treasurer and Treasurer levels.

Employers within treasury are increasingly seeking project experience and strong TMS exposure, with systems implementation experience particularly appreciated.

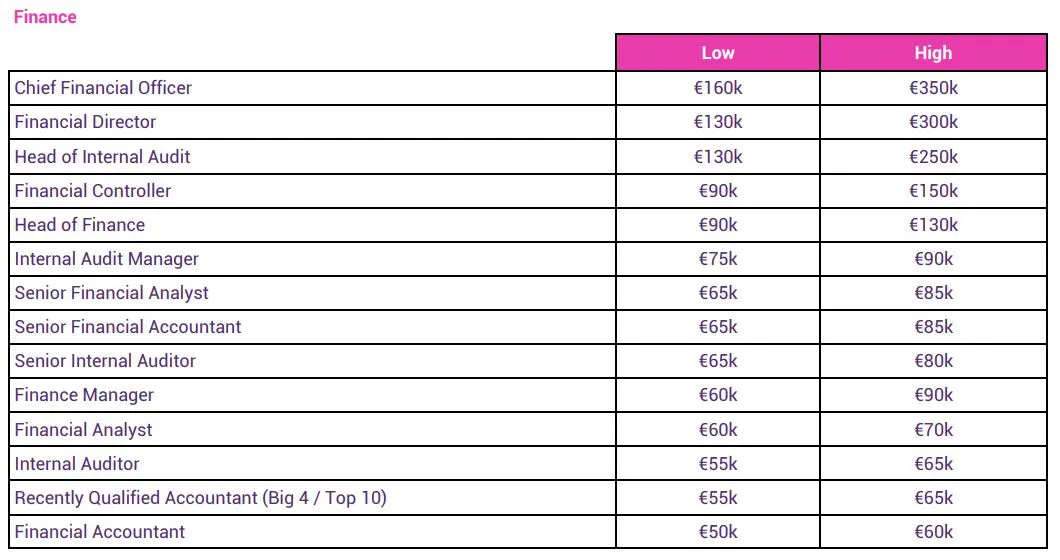

Salary Pressure

There has been significant upward pressure on salaries over the last 12 months across the board, with salaries increasing anywhere from 5% to 12%. This salary pressure has come about as a result of the combination of poor salary rises since 2018, heavy recent and continuing inflation pressure affecting every employee’s cost of living and finally a shortage of skilled staff.

Despite aggressive hikes in interest rates by the ECB for the last 12 months, inflation has remained stubbornly high and has correspondingly kept pressure on salaries.

Hybrid working:

Hybrid working is now the norm and the first question every candidate asks is what a company’s WFM policy is. The norm has settled on 3 days in the office and 2 days WFH, and we do not expect this to change much in the next few years and we believe this is part of the new reality for employees.

Travel:

With travel restrictions being removed in 2022, we are seeing a significant migration of new and recently qualified graduates to Australia and Canada and other global locations. This has made roles at the more junior level much more difficult to recruit for as the candidate supply is restricted.

Counteroffers:

Counteroffers are very prevalent at all salary levels. Many employers prefer to increase the salaries of their employees as opposed to hiring fresh talent.

It is worth noting that the counteroffered employees tend to move within 12 months, as many of the reasons they look to move for are not solely finance based.

2023 and beyond:

Oh for a crystal ball! The tight labour market experienced in 2022 has continued into 2023. We now have record employment of over 2.6 million and record low unemployment of below 4%. Thus it will be an employee driven market for now and upward pressure will remain on salaries.

Employee retention will become ever more important and speed of hire will increase your chances securing that critical new hire.

Market Sentiment Survey 2023

In January 2023, we surveyed a number of Financial markets professionals, to get their views on a number of different topics. Below are the answers to the overall survey.

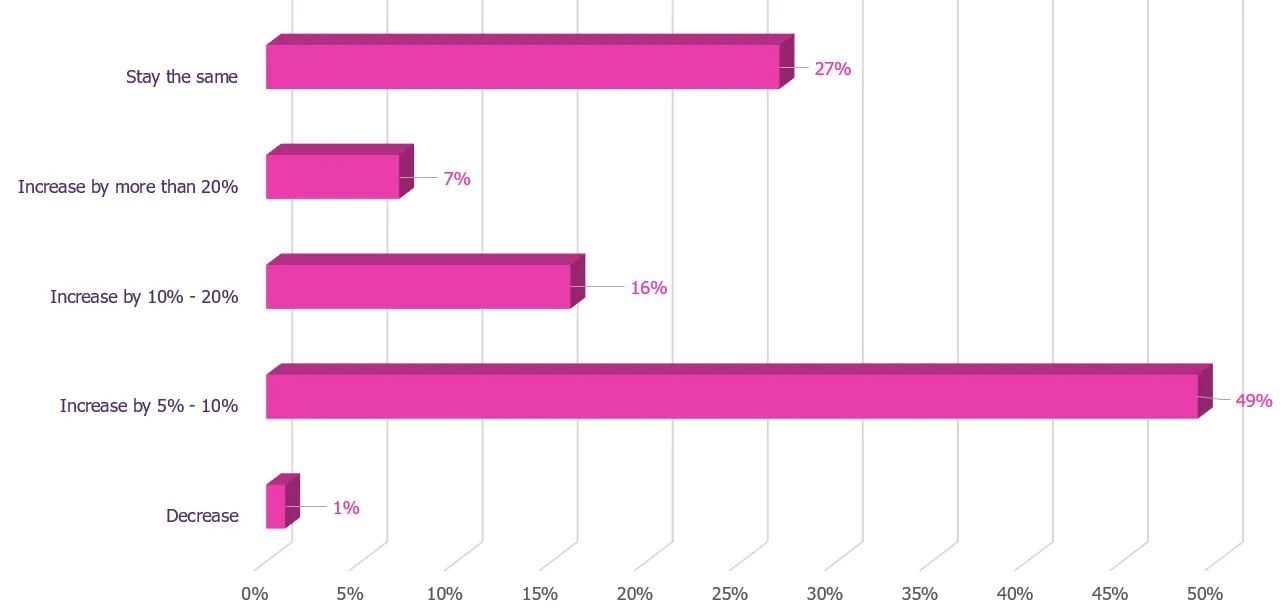

I expect my base salary in 2023 to:

Even in times of great change, layoffs in the tech sector our respondents overall seem to hold a positive view on where their salaries in 2023 will lie. With almost half expecting a 5-10% increase and just under a third of respondents are confident that their salaries will stay the same. Only 1% believe they will see a decrease in their base salary. 72% are expecting a pay rise this year.

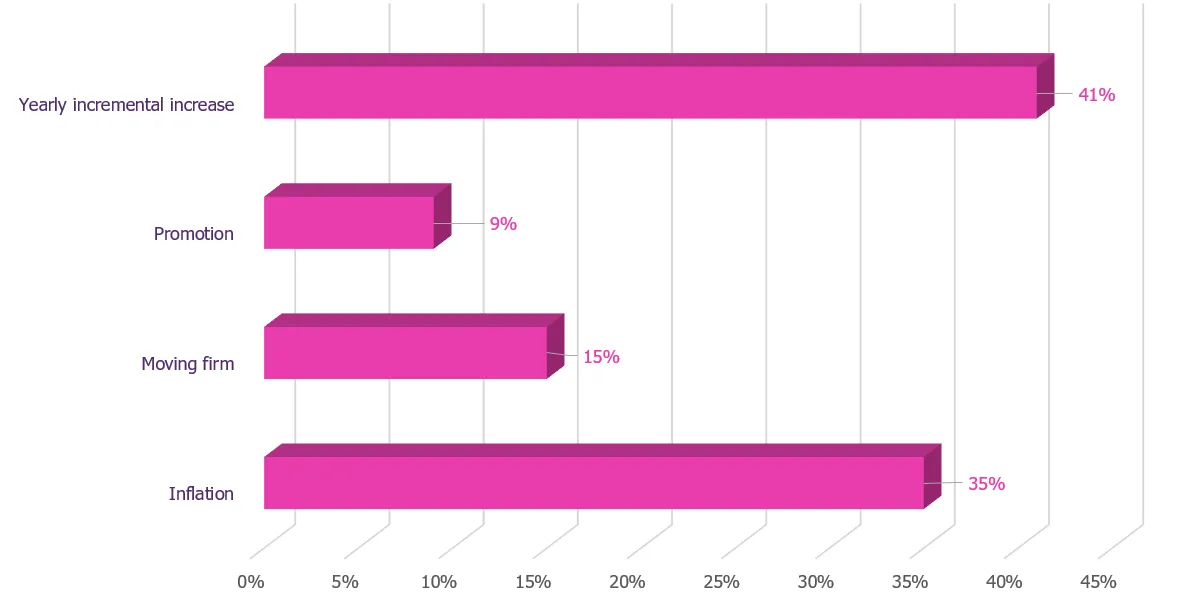

If base salary is increased, it is due to:

Out of respondents believing that their base salary would increase, 41% believe it is a result of standard incremental increase and 35% because of inflation.

15% says it would be due to moving job and 9% a result of internal promotion.

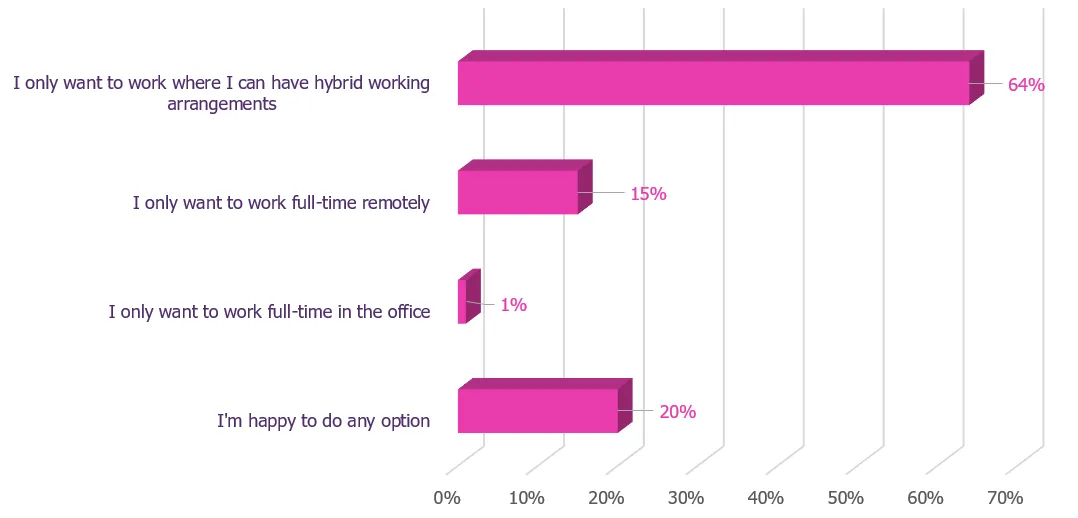

Which of these statements best reflects your thoughts?

We asked our respondents how they feel about their current hybrid working arrangements. Not surprisingly, over half stated that they would only want to work where hybrid working is on offer.

Whereas 15% said they would only work full time remotely, only 1% wanted to work in the office full time. Interestingly 20% of respondents were happy with either arrangement.

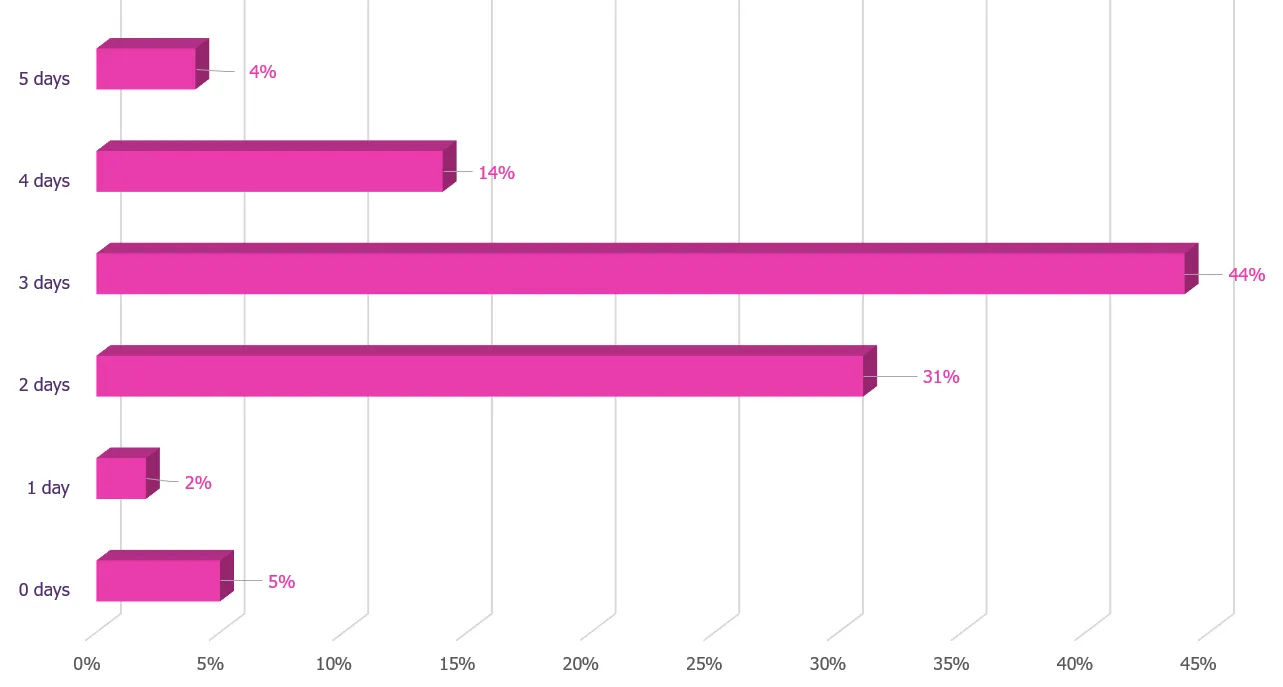

If hybrid, how many days would you prefer to work from home?

When asked if hybrid was an option, “how many days would they prefer to work from home” a majority responded that they would prefer either two or three days at home, and the rest of the week at the office. This seems to tie with what we’re seeing on the ground in financial services – on average firms are looking for their teams to be in the office 2/3 days per week.

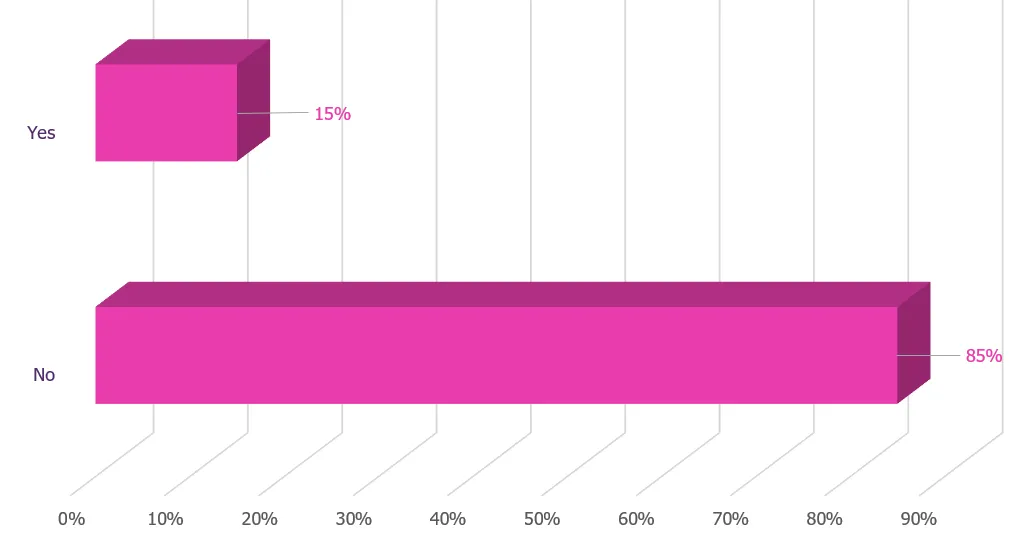

With many large/multinational companies seeing redundancies, are you nervous that your job is at risk?

The recent tech layoff does not seem to impact our respondents and a massive 85% answered that they were not worried that their job was at risk.

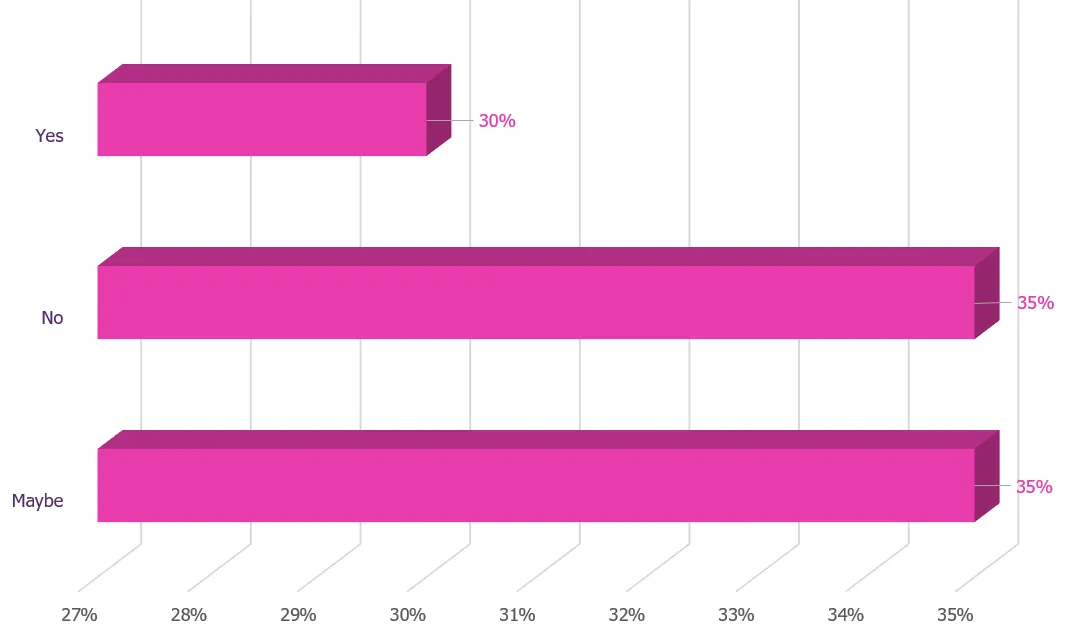

I plan to move companies in 2023:

It’s interesting to see that 65% of the respondents stated they would move jobs or consider moving jobs in 2023. Again, reflecting the levels of optimism within the sector. 35% said they would not consider a move and were happy in their current role and company.

If, answering yes to the previous question. What would the reasons for considering a move be?

Out of those considering making a move, most cited the reason they would move to be, either for career progression or for a better salary. Work/life balance and flexible/hybrid work arrangement were also high on the list of reasons with a smaller percentage stating that they were looking for a change.

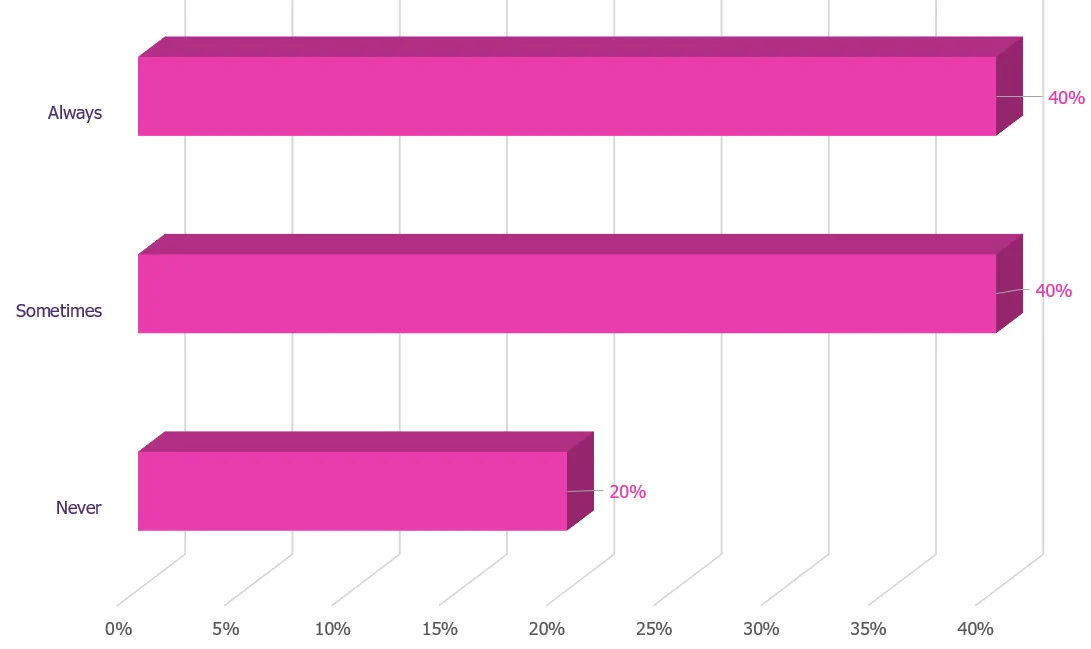

I would consider a firm’s DE&I policy before applying for a role.

Diversity, Equality, and Inclusion (DE&I) is a hot topic and something jobseekers are not only more aware of, but also see as a key factor in choosing a new employer. Our survey shows that the importance of a firm’s DE&I policy when choosing a new employer, with 40% stating that they always consider DE&I before applying for a role, and 40% sometimes.

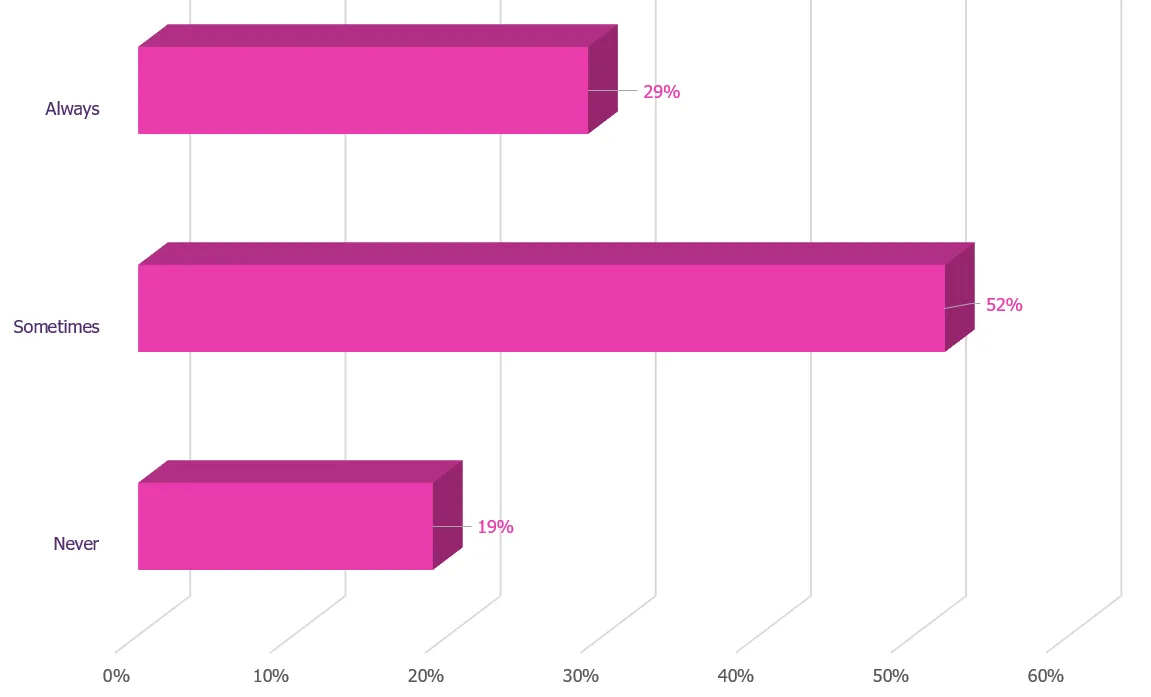

I would consider a firm’s ESG policies before applying for a role.

Like DE&I – Environmental, Social, and Governance (ESG) is also front and center for jobseekers.

Interestingly, DE&I seems to be more “front of mind” for our respondents, with over 40% always considering an employer’s company’s DE&I policies before applying for a role. Whereas only 29% would always consider their ESG policies. As the green agenda gathers pace, we expect this figure to increase significantly.

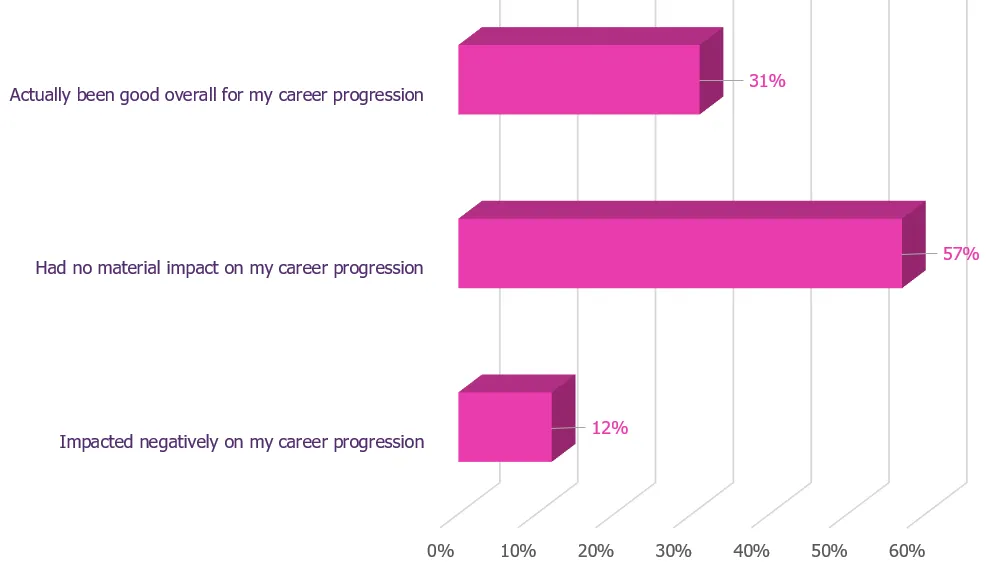

COVID has:

Perhaps unsurprisingly over half of all respondents felt that COVID had no material impact on their career progression over the last few years. In fact, 31% felt that it had been a good thing for their career.

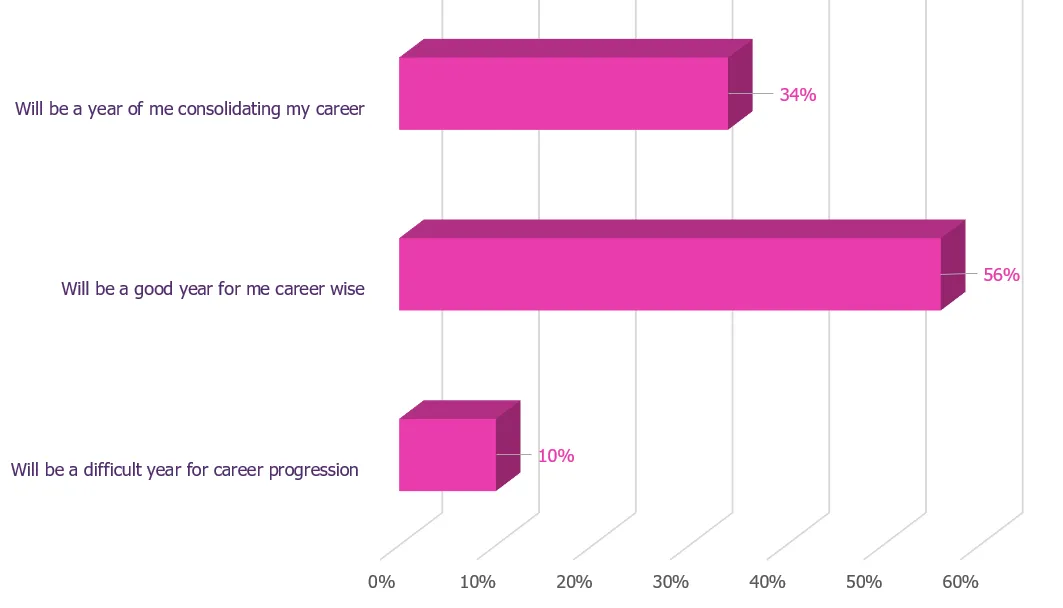

2023:

More than half of our respondents (56%) believe that 2023 will be a good year for them careerwise, with only 10% foreseeing it to be a difficult year. This positive market sentiment is good news for Financial services.

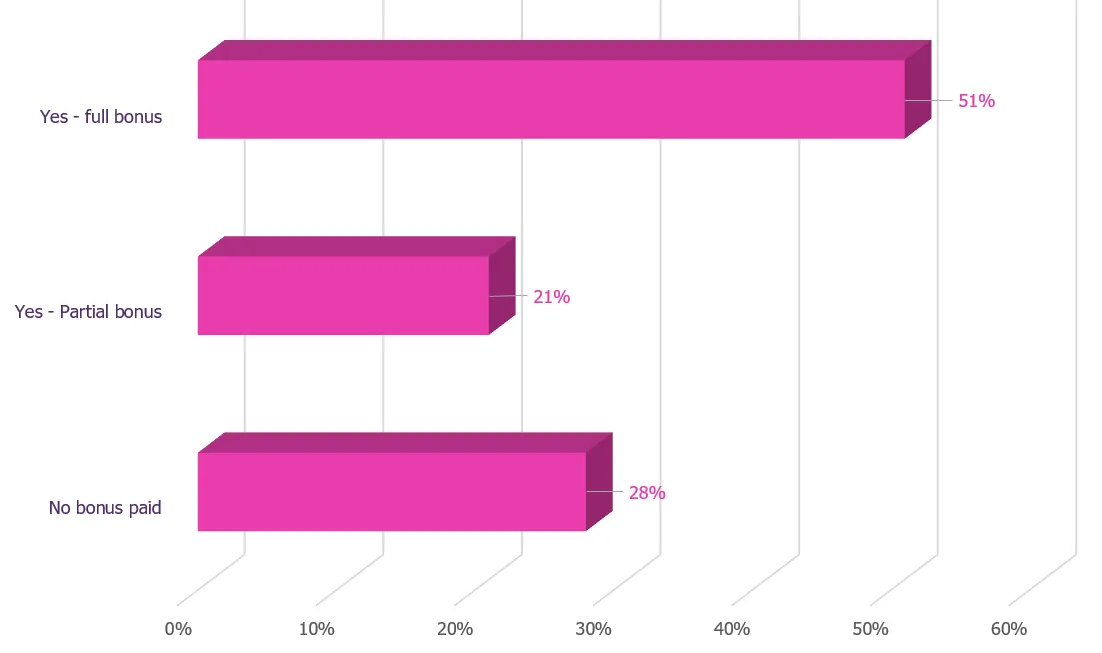

In 2022, were you paid a bonus?

As bonuses are always a good barometer of the health of the employment market, it is great to see that over 51% of our respondents received their full bonus in 2022 for 2021, with 21% partial bonus. The sentiment this year is slightly different. Having spoken to a number of CEOs, their view is a flat bonus on 2022 is a good result and over 45% expected bonuses to decrease by up to 20% on last year.

The Banking & Treasury Market

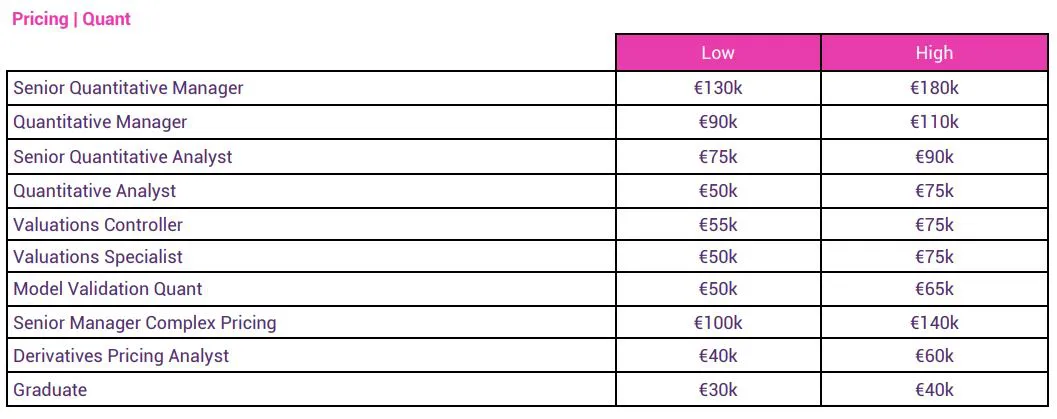

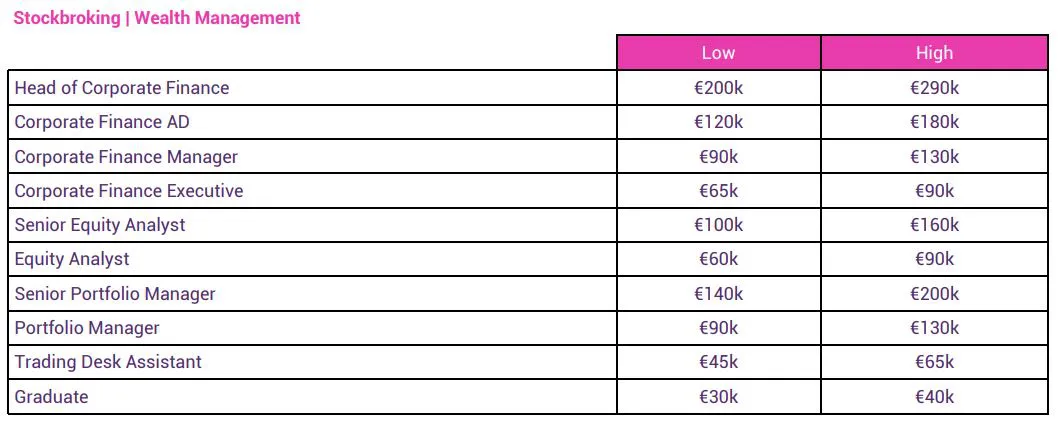

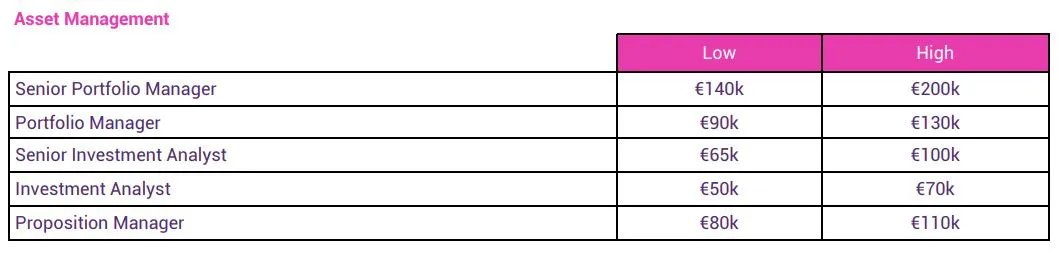

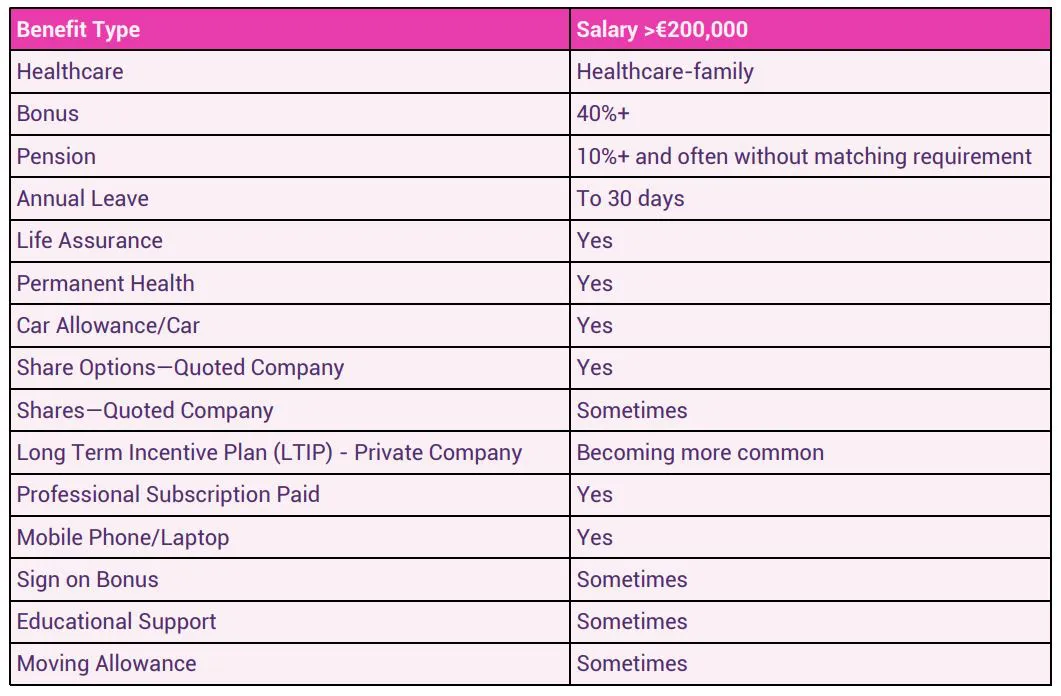

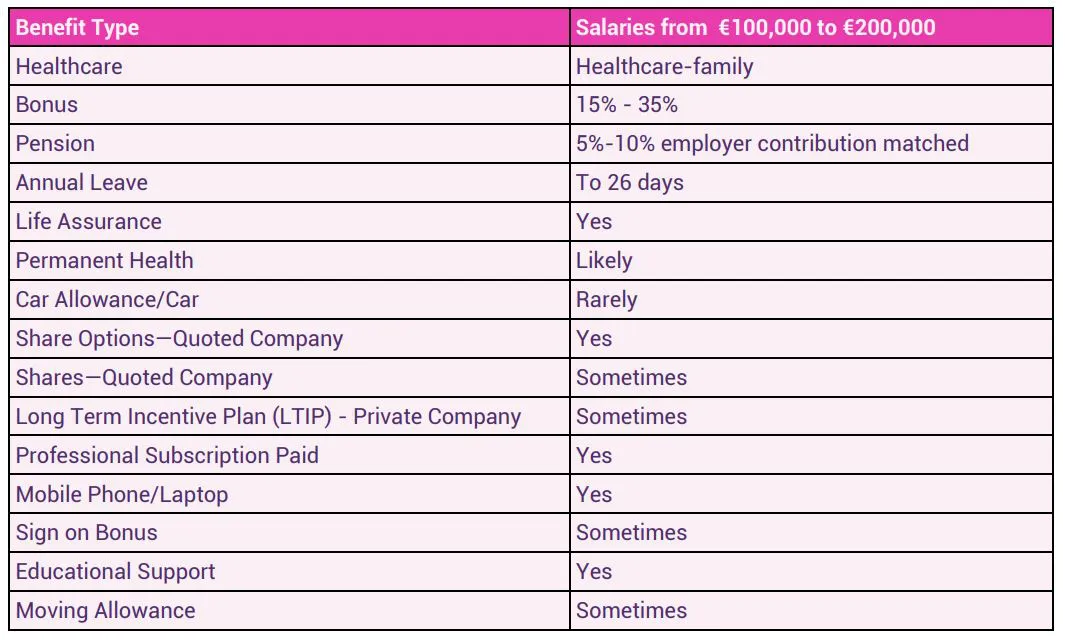

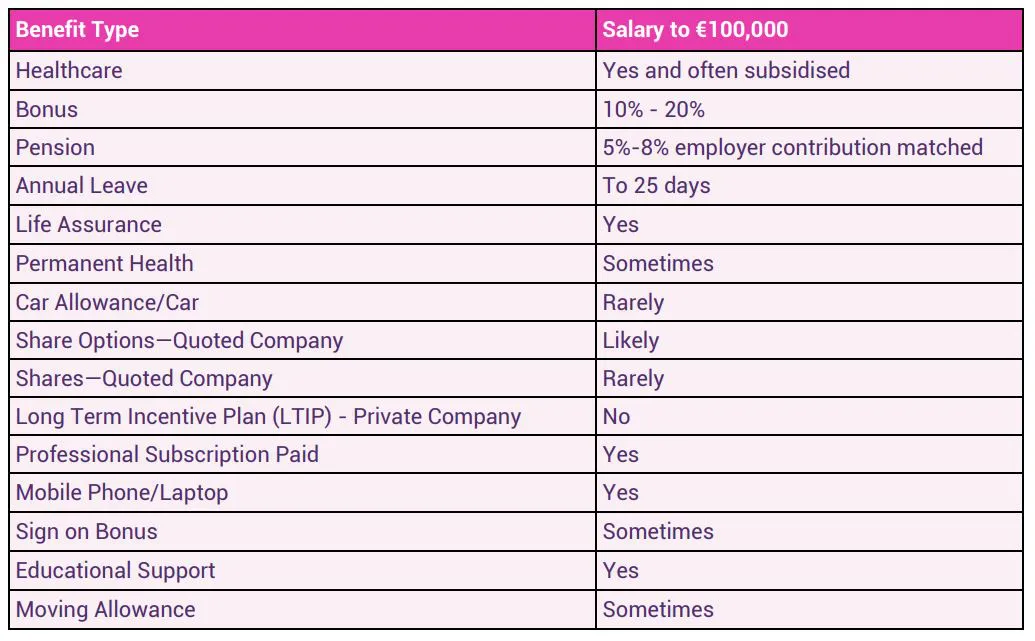

Benefits package:

- Share options and LTIPs normally have a vesting period in place.

- A private company can use an LTIP to incentivise their “C” suite without giving equity.

- Increasing paid holidays is common for clients to sweeten a salary package.

- Some clients give a fixed amount to their employees in addition to base salary – a flexible benefits package, which they can spend in any way they want to.

The Panel

Sustainability

As time moves on the sustainable responsibility of employers are becoming more and more important, therefore we here at The Panel take great pride in doing our best in meeting our target in this area. We take responsibility for our candi- dates, clients, and every part of our business in order to offer and supply solutions that positively impact those around us.

Knowing that you are partnering with a responsible organisation, should offer you peace of mind.

Read more on our Sustainability Policy here.

Diversity & Inclusion

In The Panel we actively focus on sourcing talent through a D&I lens – we know diverse teams make for better functioning and more collaborative teams.

The Panel and our Managing Partner Anne Keys were instrumental in the setup and launch of 100 Women in Finance in Ireland in 2017 and Anne is currently acting as the Co-Chair for 100 Women In Finance Dublin.

Anne organises and hosts iNED workshops for women. Attendees include C-suite executives considering a career as an iNED and for women who have just moved into this space.

In November 2017, The Panel signed up to the Ibec/30% Club’s “Voluntary Code of Conduct for Recruitment and Executive Search Firms Code”.

This Code recognises the importance of search firms and client organisations working together to deliver change based on four principles:

- Strategy & Goals

- Talent Pipeline

- Prices

- Monitoring & Reporting

What can The Panel help you with?

Regulations – guiding candidates and clients through the Irish regulatory environment.

Market analysis – updating candidates and clients on current trends.

Talent acquisition – for clients we help source the best candidates for the role at hand.

Advice – we provide our candidates and clients with the most up-to-date information available regarding the market, the recruitment processes and the best remunerative options available to both.

Technology & Resources – offering candidates and clients the most up to date in recruitment and AI technology, enabling a quicker and more efficient recruitment process from start to finish.

Diversity & Inclusion at The Panel

As a company The Panel has successfully strived for internal diversity and inclusivity and in doing so we firmly believe that puts us in a strong position to be ambassadors for our clients in an Ireland that is becoming ever more progressive, diverse and inclusive.

- We support groups for women in business e.g. 100 Women in Finance & Women Executives.

- We employ 11 different nationalities with various cultural and religious beliefs.

- We have a higher proportion of female employees.

- We have two joint MD’s at the Panel, 1 male and 1 female.

We believe we are one of the most diverse and inclusive recruitment companies in Ireland, putting us in a position to help our clients achieve the same.

We instil the following approach through rigorous training of our employees;

- Equal Employment Opportunity is a fundamental right of all employees and applicants for employment.

- The Panel undertakes not to discriminate unfairly against any applicant in respect of the subject matter of

disclosures made pursuant to the pre-engagement screening process or any other information revealed

during the engagement process. - All applicants are provided a full and fair opportunity for employment, without regard to race, colour,

religion, national origin, disability, gender, age, sexual orientation, genetic information or parental status - We promote equality for all candidates.

- We foster and support a globally diverse and inclusive workforce with our clients and place a high value on

diversity and equal opportunity. - We believe it is important for applicants to be considered for the employment of their choice and have the

chance to perform to their maximum potential. - The Panel is an equal opportunity Employer and Recruiter.

Your Banking & Treasury Team

For more information contact:

Alan Bluett, Partner

t: +35316377086 | e: alan@thepanel.com

Alan Bluett joined The Panel in 2004 and is a Partner in the business. Prior to joining The Panel, he worked for 10 years as the Head of Fixed Income Trading for RBS in Dublin. He has over 20 years of specialised Banking & Treasury recruitment experience and Alan manages the Banking & Treasury and Insurance recruitment practices within The Panel.

In this role he focuses on recruiting from manager right up to executive level within Treasury, Risk, Compliance, Wealth Management and Cor- porate Treasury. He is uniquely networked within the Banking and Treasury market in Ireland and has been guest speaker on numerous industry panels and events.

Alan is the Regional Director of the Irish Chapter of the Professional Risk Managers International Association (PRMIA), a Patron of the Irish Association of Corporate Treasurers (IACT), a Member of the Institute of Bankers (MIB) and a Fellow of the Employment Recruitment Federation (ERF).

For more information contact:

Edna Hogan, Senior Recruitment Consultant

t: +35316377092 | e: edna@thepanel.com

Edna joined The Panel as a Senior Recruitment Consultant within our Banking & Treasury in May 2022.

Edna’s background is in banking (retail and investment), enterprise, charity, and media at senior management levels and most recently as the Founder of The Tanzania Chamber of Commerce in Ireland and Europe.

Edna holds a Degree in Journalism, Banking qualifications from University College Dublin.

Her extensive volunteering and philanthropic experience have made her central to many cross-border initiatives between Ireland and Tanzania.

For more information contact:

Darina Heavey, Senior Recruitment Consultant

t: +35316377015 | e: darina@thepanel.com

Darina joined as a Senior Recruitment Consultant in November 2022.

Darina has many years of experience in the Investment and Private Banking industry and brings with her a multitude of knowledge to this role. She also holds many years of experience in sales, strategy, and planning within the technology space.

Darina holds a Level 9 Diploma in Corporate Governance from UCD Michael Smurfit Business School and is a Chartered Institute for Securities and Investment fellow. She is also an Associate of the Institute of Taxation of Ireland.

For more information contact:

Will Kavanagh, Senior Recruitment Consultant

t: +35316377090 | e: will@thepanel.com

Will joined us in January 2023, as a Senior Recruitment Consultant.

Prior to working at The Panel, Will worked for a large multinational technology company where he was a Technical Sourcer – finding, engaging, and screening candidates. During this time Will developed a data-based approach to recruitment and is always looking to improve processes and drive efficacy through using data.

Previous to working in recruitment Will worked in Financial Services for 5 years and has experience in Banking and Accountancy.

Will completed a Bachelor of Arts in Sociology and Economics & an MSc in Strategic Management and Planning all from UCD.

For more information contact:

Farah Daoub, Recruitment Administrator

t: +35316377014 | e: farah@thepanel.com

Farah has been with The Panel since July 2021. She supports both our Funds & Investment Management division and our Banking & Treasury division.

She holds a key role in the recruitment process for both areas of the business.

She holds a QQI Level 5 certificate in Business Administration, Customer Service, and Bookkeeping.