EXECUTIVE

ACCOUNTANCY & TAX

AIRCRAFT

LEASING

BANKING &

TREASURY

ESG &

SUSTAINABILITY

HR & BUSINESS

SUPPORT

funds & investment management

salary guide

2024

funds & investment management

salary guide 2024

Financial Services

Author: Anne Keys, Joint Managing Partner

Download the 2024 salary guideView the 2023 salary guideView all salary guidesExecutive Summary,

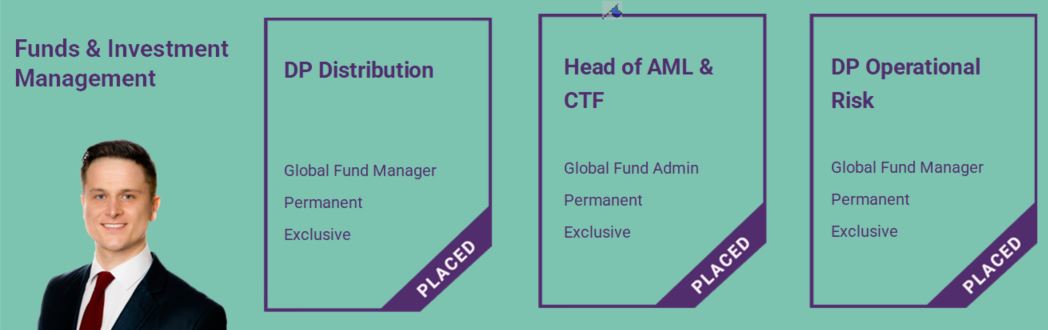

Funds & Investment Management Review

By Anne Keys, Joint Managing Partner

Ireland’s Funds and Investment Management Sector continues to solidify its position as a globally recognized and respected hub for investment funds, serving as the second largest domicile in the EU and a leader in ETFs and Money Market funds. As of September 2023, Ireland managed €3.7tn AUM. The country’s strong regulatory environment, stable government, deep ecosystem of service providers, and highly educated talent pool remain key attractions for funds and investment managers. The industry saw plenty of M&A activity in 2023 with Caceis completing its acquisition of RBC in July, TMF Group acquiring Goodbody Fund Management, Waystone acquiring Link Fund Solutions, Apex acquiring MJ Hudson businesses and BoA’s Irish depositary business, to name a few.

Hiring trends

Despite global market challenges and geopolitical events in 2023, the funds and investment management sector in Ireland demonstrated resilience. Hiring activity remained strong, particularly for governance roles in Compliance & AML, Investment Risk, and Operational Risk and Internal Audit. The demand for experienced candidates in Head of Function (PCF) positions within the sector continued to outpace supply, driving compensation packages upwards. The Panel was retained by key clients to source more experienced candidates for Head of Function roles, adding bench strength to existing areas to future proof organisations for continued growth and more complex business requirements. With the continued tsunami of regulations affecting the sector eg IAF, SEAR, DORA, ELTIF & ESG reporting etc, The Panel expects another year of strong regulatory hiring from all firms in this space. In 2023, senior governance candidates secured on average a 20% increase in their basic salary to move roles, while those with experience in highly sought-after governance areas were able to command even higher increases of up to 35%.

According to a recent survey by IBEC, the overall expectation is on average 3.8% incremental pay increase in the financial services sector in 2024, however, the governance sector is likely to continue to see higher salary increases due to the persistent shortage of qualified candidates. External moves and promotions remain the most significant factors in boosting a candidate’s overall compensation package. Pay and benefits, upskilling and career development opportunities, and flexible working arrangements, continue to be top priorities for candidates across all sectors of Financial Services.

Recruitment for CEO/Head of Ireland roles was more balanced in 2023 compared to previous years. While several key CEOs transitioned into the independent non-executive director (INED) space, some of their replacements were sourced internally from local management teams or from international executives who moved to Ireland to take up this highly sought-after leadership position.

In terms of new firm set ups, 2023 attracted niche players to set up a presence in Ireland, as most of the key global investment managers have put substance on the ground in Ireland either via their own Proprietary ManCo’s or Third Party ManCo’s. One of the most exciting new players to Ireland this year, is a Renewable Energy Investment Manager who is setting up an AIFM to drive the growth of their funds in Europe. Ireland is well on its way to establishing itself as a hub for ESG and Sustainable funds and as noted below, our agile workforce is upskilling and reskilling in this area at a rate of knots!

Private Markets, PE and Real Estate

We have seen a significant demand for candidates with private equity, private debit, private credit and real estate experience and knowledge across finance/accounting, fund operations, middle office and legal in the fund admin and investment management/ManCo area. It has been the asset class of choice by investors throughout 2023. PWC in their recent global survey indicated that private markets revenues will account for around half of global asset and wealth management revenues by 2027.

Future skills

The industry is undergoing significant changes due to digitisation of the industry. AI is being used in risk management (using AI-powered algorithms), portfolio optimisation and client behaviour analysis. Digital technologies are transforming the way the industry operates from customer onboarding and servicing, investment research and analysis to compliance and reporting. Blockchain developments in 2023 allowed for the tokenisation of Money Market Funds between BlackRock and Barclays using JP Morgan’s Tokenized Collateral Network facilitating a collateral settlement for an OTC derivative transaction for the first time. Larry Fink CEO of BlackRock commented “..the future will be tokenized.” As these technologies gain traction, we are seeing an increase in hiring in the Fund Admin and Investment Management space for AI researchers, digitalization architects and Blockchain specialists.

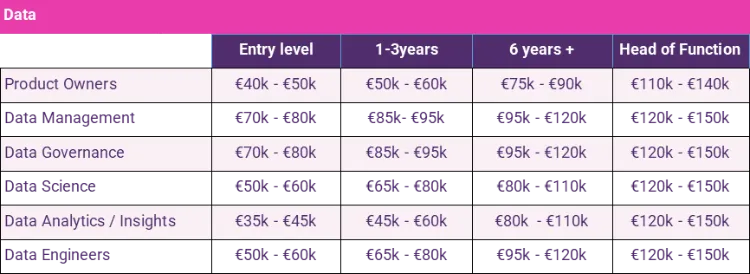

When hiring specialist skill sets such as Risk and Investment Management, we are seeing clients favour candidates with strong technology skills particularly in Phyton and Power BI. Experience in these applications, enables candidates to assist firms in automating processes and key reporting requirements. This expertise sets candidates apart and can be a real differentiator in the hiring process. With the increased focus on big data, candidates with expertise in data and data analytics continue to be in demand by firms in the funds and investment management sector.

A notable trend in 2023 was the emphasis on upskilling and reskilling, particularly in areas such as ESG/Sustainability, AI, Blockchain, and digitalization. The Panel established a dedicated ESG/Sustainability desk in 2023 in response to client and market demand for talent in this domain. Already we have seen candidates pivot into senior ESG roles in the Funds and Investment Management sector in Ireland namely ESG Risk and ESG reporting. We anticipate that ESG/Sustainability will be a significant focus for hiring in 2024.

Soft skills

Throughout 2023, soft skills remained of critical importance to firms when hiring for talent for the future. Candidates that demonstrate a curious, open and growth mindset, digital literacy, and agility to adapt and drive change are highly sought after. These skills are essential for success in a rapidly changing world, where businesses need to be able to innovate and respond to new challenges quickly. In addition to these specific skills, firms continue to look for candidates who have strong communication skills, leadership qualities and potential, the ability to work independently and as part of a team, and the ability to manage their time effectively. Candidates that invest and develop their soft skills, set themselves apart from other candidates and in today’s world significantly increase their chances of landing their dream job.

The Panel are long-term supporters and sponsors of basis.point.

iNED space

In the independent non-executive director (iNED) space, the number of new roles remained flat in 2023 due to a slowdown in new fund launches. However, new launches in existing funds remained very busy. The quality of iNED candidates continued to impress, with a steady stream of executives seeking to transition into iNED roles. The Panel anticipates an increase in opportunities in 2024 as experienced iNEDs with over 10 years of tenure retire or step down from their boards. In 2024, The Panel expects to see a further demand from clients to engage with our firm to conduct independent assessments and source new iNEDs for their boards, moving away from reliance on referral lists. The combination of DEI-driven board rebalancing and the introduction of expertise in ESG and digitalization reflects a growing recognition among firms of the importance of building diverse, knowledgeable, and forward-thinking boards that can effectively guide their organizations in an increasingly complex and rapidly changing business environment.

100WF iNED event on ESG with Change by Degrees

The Panel sponsored a 100WF iNED event on ESG with Change by Degrees and a joint event with The Panel and IoB on how to secure a board seat. Both events were waitlisted, demonstrating the high demand for continuous learning among the iNED community and the growing interest among executives in securing both internal and external board seats.

Hybrid

Hybrid working arrangements remain a contentious issue for both firms and candidates. While most firms are comfortable with a 3-day office presence, some have mandated 4-day or 5-day return-to-office policies. Ireland has embraced the hybrid working model, however, decisions on hybrid arrangements are often made by HQ in other locations with differing views on return to the office. The Panel’s candidate sentiment survey found that a move beyond 3 days in the office is a significant factor for candidates considering or actively seeking new roles.

Attracting the Next Generation

The recent Financial Services Ireland (FSI)/Amárach Research on attitudes of 18–24 year-olds towards Financial Services jobs in Ireland gives the industry some positive news. 54% said they would consider a job in FS, 68% said they believed workers in the industry were well paid and 55% said they believed the industry offers employment opportunities using cutting-edge technology. The future looks bright in terms of the next generation of talent in Financial Services!

Conclusion

Ireland remains a premier destination for funds and investment management, boasting a robust talent pool, competitive compensation packages, and a supportive regulatory environment. As the industry continues to evolve, firms and candidates that embrace the evolving trends of ESG/Sustainability, soft skills development, and hybrid working arrangements will be well-positioned for success. We will keep a close eye on the unfolding events beyond Ireland’s borders, as they impact the markets and our internationally focused Funds and Investment Management industry here. We anticipate a more balanced hiring market in 2024, characterized by a “talent war” in specific areas of the industry, particularly in governance, ESG, digital, and technology.

Funds & Investment Management Salary Guide

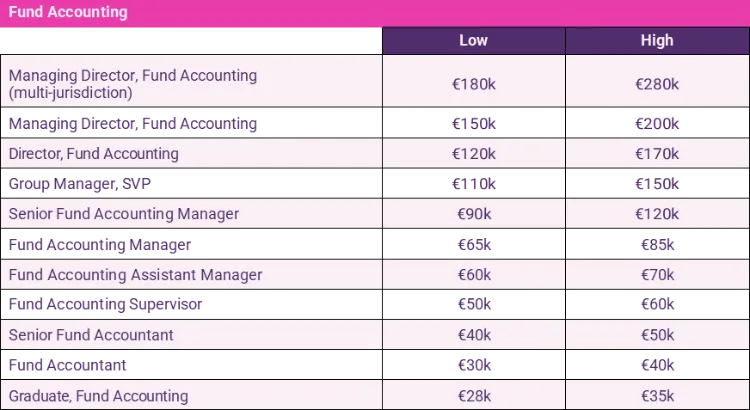

Funds Administration & ManCo Insights

By Liam Murphy, Director

After a cautious start to hiring in the Fund Administration and ManCo sector in 2023, hiring picked up in the latter half of the year, with a particular focus on governance-related roles and hiring support staff to work alongside PCF/Head of Function.

Here’s a more detailed breakdown of the key trends:

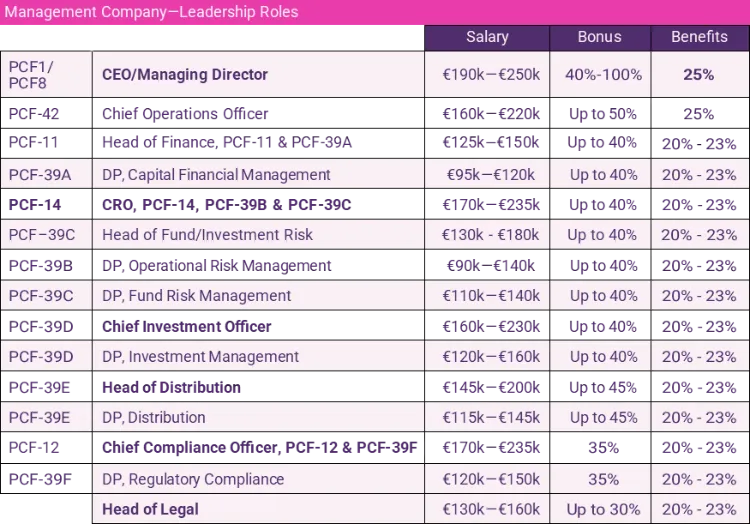

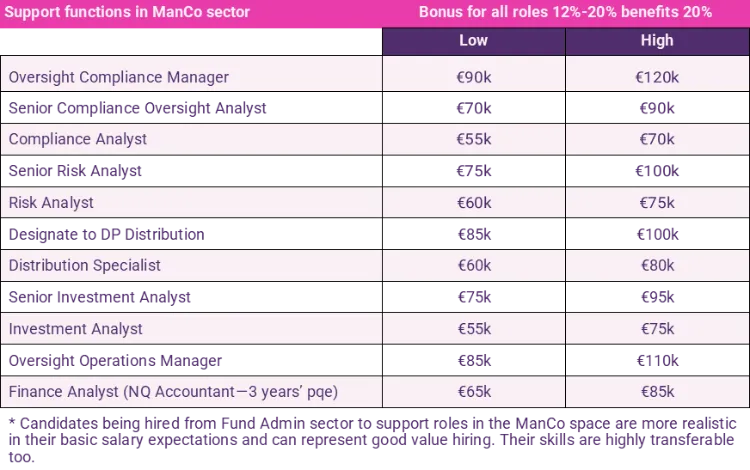

ManCo

2023 witnessed a surge in demand for support staff and designate professionals to assist the PCF (Pre-approved Control function) across various aspects of the ManCo business.

Driven by CBI (Central Bank of Ireland) requirements, firms prioritized building out their substance. They were committed to ensuring that their Heads of Function (HOFs) received the necessary support to guide the firm through its next stage of development.

ManCo firms typically sought candidates with prior ManCo or Investment Management experience to facilitate a smooth transition. Candidates who successfully transitioned to new roles typically received a salary increase of 10-15%.

There was a significant focus on hiring support staff with strong technology skills (especially Python) in the ManCo space in 2023. We anticipate that technology and digital knowledge and expertise will be critical for recruitment in 2024.

The Third Party ManCo segment experienced a wave of consolidation in 2023 as many independent firms were acquired by major international firms with a presence in Ireland.

Fund Administration

Global Fund Administrators headquartered in Dublin implemented hiring freezes that extended into Q1 2023 beyond the typical Q4 period.

Firms focused on cost reduction, and hiring budgets were allocated on a case-by-case basis.

Candidates with expertise in private equity, private markets, and private debt fund accounting remained in high demand throughout 2023.

Demand for roles in Investor Services, Custody, Financial Reporting, and Middle Office decreased.

Firms responded to the evolving digitization of the sector by expanding their capabilities in niche areas like Technology, Data Analytics/Governance, and Client Reporting.

Overall, the Funds & Investment Management sector showed resilience in 2023, despite the challenges faced by the industry. Hiring trends reflected this resilience, with a focus on building out substance and integrating technology into the business. We expect this trend to continue in 2024.

The Panel Corporate and Individual sponsors of basis.point

The Panel and IOB joint event.

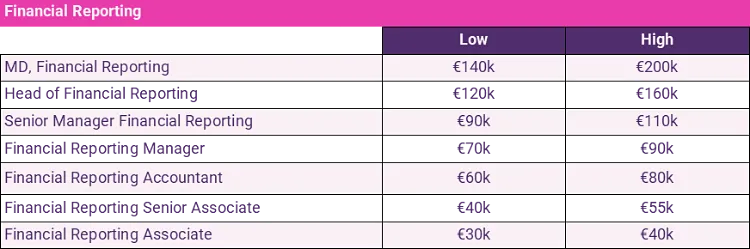

Finance & Accounting Insights

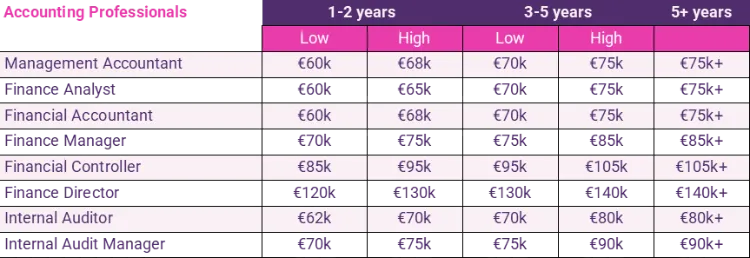

By Andrew Wynne, Recruitment Manager

The demand for skilled accountants remains robust, driven by the continuing strong performance in the financial services sector. Firms are actively seeking professionals with a strong foundation in financial reporting, regulatory compliance, and risk management. Regulatory changes and increasing complexity in financial reporting have contributed to a sustained need for professionals well-versed in accounting standards and compliance.

In response to the evolving regulatory environment, there is a notable emphasis on candidates with expertise in navigating complex financial frameworks and staying abreast of the latest industry regulations. Given the competitive nature of the market, employers are placing a premium on candidates who not only possess technical proficiency but also demonstrate adaptability and a strategic mindset. There is a growing emphasis on hiring professionals who can contribute to business decision-making processes and offer insights that go beyond traditional accounting responsibilities.

Flexibility on remote work options continue to be high on candidates’ priority list, because of this many organisations continue to adopt flexible arrangements to attract top talent. This shift has also continued to benefit and expand the pool of potential candidates, with a hybrid work model of usually 3/2 now being the accepted norm.

Salaries in the accounting and finance sector have seen a competitive increase, as organisations strive to attract and retain top talent. Overall, the accounting recruitment market in financial services is characterised by a strong demand for skilled professionals, a focus on regulatory expertise and technology proficiency, continued flexibility on remote work options, and a commitment to fostering diversity and inclusion in the workforce.

Key Trends

- Strong demand for qualified accountants: Employers across the financial services sector are seeking qualified accountants, in particular at the 1-2 years PQE given the candidate shortage at this level

- Increase in trainee recruitment: The Big Four accounting firms have increased their trainee intake, with a particular focus on graduates interested in Corporate Finance and Advisory Services.

- Salary increases: The average salary package for newly qualified Chartered Accountants in Ireland has increased by 6.6% (to on average a €62,866 base salary) compared to last year.

The Panel Accountancy & Tax team at the ACCA Conference at Trinity College.

Challenges Facing the Market

- Talent shortage: The ongoing shortage of qualified accountants is putting pressure on employers and making it more challenging to fill open positions.

- Emigration: There has been an increase in the amount of Accounting & Finance talent leaving the country, with a high percentage of the Newly Qualified market emigrating for a working holiday.

- Attracting and Retaining Talent: Attracting and retaining talent is becoming increasingly challenging. Priorities have shifted with work-life balance, flexible work arrangements, and a sense of purpose in candidates careers becoming even more important.

Outlook for 2024

- Hiring activity is expected to remain strong in 2024 as multiple industries continue to seek high calibre candidates.

- Increased emphasis on skills: Employers will be looking for candidates with a strong combination of technical skills and soft skills, such as communication, problem-solving, and adaptability.

- Focus on digital skills: The demand for accountants with digital skills, such as data analytics and financial modeling, is expected to continue to grow.

The Panel attends the Ireland’s Women in Finance Charter event at Government buildings with Minister for State Jennifer Carroll MacNeill

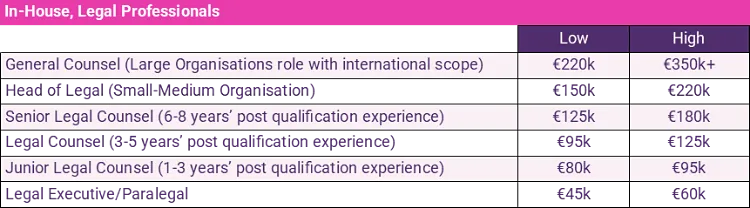

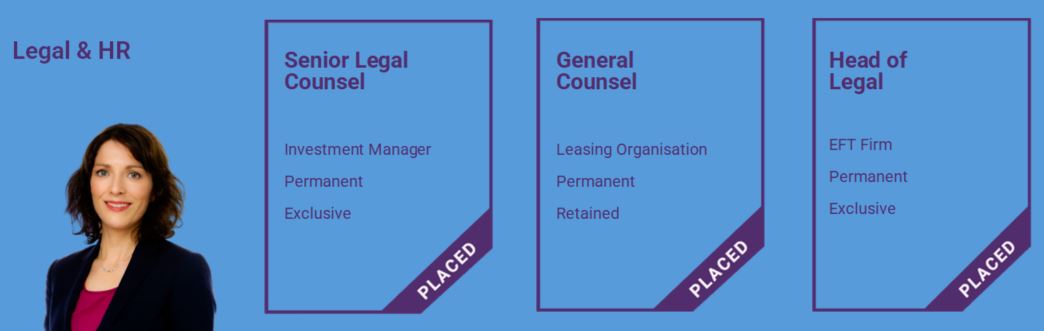

Legal Insights

By Sarah Kelly, Partner

2023 Review

We found 2023 to be an exceptionally busy year in the financial services legal recruitment market. This followed the trend across most sectors to build out the in-house legal function as a cost saving strategy (long term!)

Our team managed mid-senior level assignments across investment management firms, ETF firms, private equity, insurance, banking, fintech and aviation leasing organisations.

The roles tended to range from min. 5 year pqe lawyers up to General Counsel and Head of Legal level.

Some of the smaller entities (especially in the Private Equity space) hired their first In-House Counsel, with a view to expanding the team in the next 12-24 months. As mentioned above, the decision around these hires was being driven by the long-term cost savings of bringing the legal work (where possible) back in-house.

Some of the large investment management firms hired additional Legal Counsel, bulking out their existing teams. Interestingly, a couple of these positions had originated in the London or Luxembourg markets, but our clients decided to complete the hire in Dublin – a win for the Irish market!

In other good news for the Irish market in 2023, The Panel was exclusively engaged on a project to hire a General Counsel and senior leasing lawyers for a new entity setting up in Dublin. Further proof that Ireland offers new entrants a superb pool of talent in the legal financial services market.

The Panel sponsors and hosts CLO Network

The Panel hired for a number of structured finance and derivatives lawyer roles for various financial services businesses this year. This is not an area we see that much movement in typically, so it was good to see some fresh opportunities come on the market for Irish based lawyers with this specialist skill set.

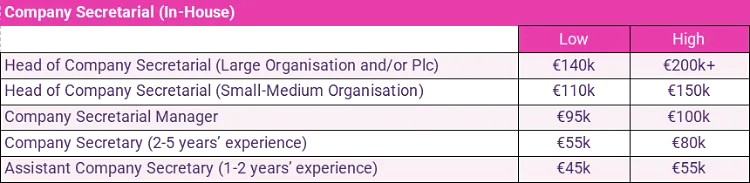

It’s no surprise that Company Secretaries and Corporate Governance professionals continued to be in demand from services providers, as well as those recruiting for their in-house governance teams. This demand has certainly seen salaries in this area hold their own, if not increase. The topic of the importance of company secretaries came up at an event The Panel organised this year with Winmark entitled: Boards and General Counsels.

We had an exceptional panel of experienced Non-Executive Board Directors (many of whom also had successful careers as lawyers) who kindly share their thoughts and advice on navigating the Board journey.

2024

Like many other professionals in the market, legal candidates are keen to secure positions in businesses where they are confident they will be offered quality work in a collegiate environment and where they are sure the organisation will have a close eye on nurturing a diverse and inclusive work force. Companies that offer hybrid and flexible working arrangements are top of the list – this is a request from almost all legal and company secretarial candidates we represent.

We anticipate that in-house legal teams, as they mature, will continue to add to their existing teams. We also expect to see more companies making their first legal hire, especially companies that have set up offices in Dublin in the past 12-18 months. Demands for financial services legal regulation experience and investment funds experience will continue, as will data privacy and AI legal expertise.

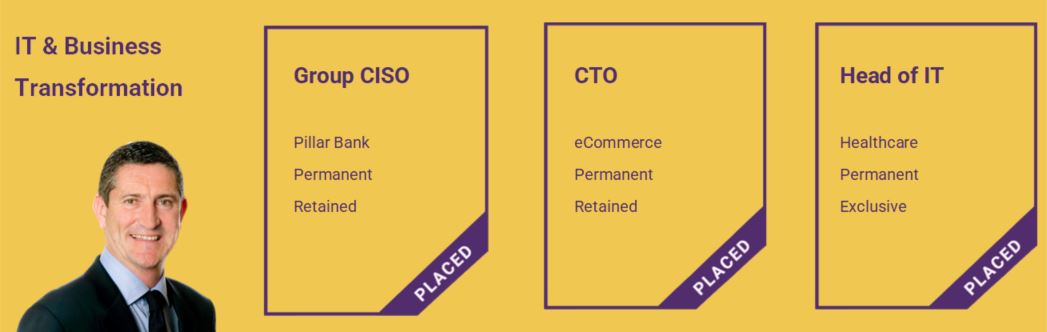

IT & Business Transformation Insights

By Fergal Keys, Senior Partner

The IT Executive market has been busy in 2023 with a number of key openings of senior IT Executives within the Financial Services (including Banking and Funds), Fintech, Data, Digital and Industry sectors. Technology Leaders are driving people centric transformation and change as companies seek ways to deploy new technology, automation, processes and data to increase efficiencies and decision making. This year saw companies in Ireland focused on accelerating growth amidst global economic disruption, a dynamic landscape of rapidly advancing technologies, and shifting operating models. Businesses are seeking to build more resilient and sustainable enterprise models at the same time as future proofing the core.

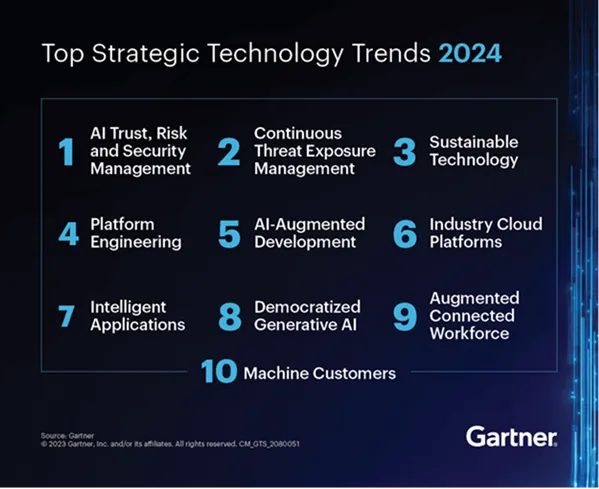

When it comes to the technology market, the word that probably comes to mind for 2023 would be artificial intelligence (AI). While AI /ML has dominated a lot of tech thinking this year – the Irish market was very busy with Data, Cloud, Software, CyberSecurity, Digital, PMO and Business Change-Transformation searches.

When it comes to the technology market, the word that probably comes to mind for 2023 would be artificial intelligence (AI). While AI /ML has dominated a lot of tech thinking this year – the Irish market was very busy with Data, Cloud, Software, CyberSecurity, Digital, PMO and Business Change-Transformation searches.

The Hybrid working model is here to stay – so there is a big demand for candidates with experience in Cloud Services – Infrastructure, DevOps, Site Reliability, Systems, Cloud Engineers as well as technical-desktop support specialists at all levels.

- CyberSecurity and Digital Resilience will continue to be in demand into 2024.

- Data – businesses continue to be data driven so candidates with a background in Data Analytics/ Engineering and Science are always sought after.

- Process Improvement – Businesses are continuously looking to automate functions.

- Software – Software engineering background with expertise in Java, .Net, Python, React and Angular JS proving to be highly sought-after skillset.

By 2027, 80% of CIOs will have performance metrics tied to the sustainability of the IT organisation. Source: Gartner

The Panel attends the Dublin Tech Summit.

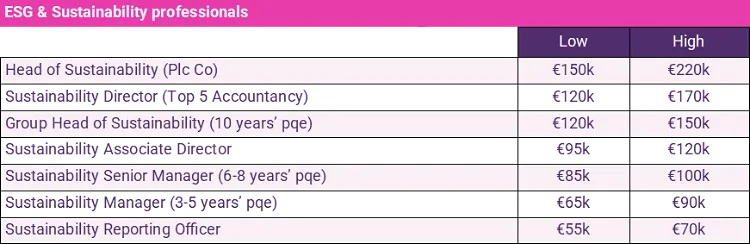

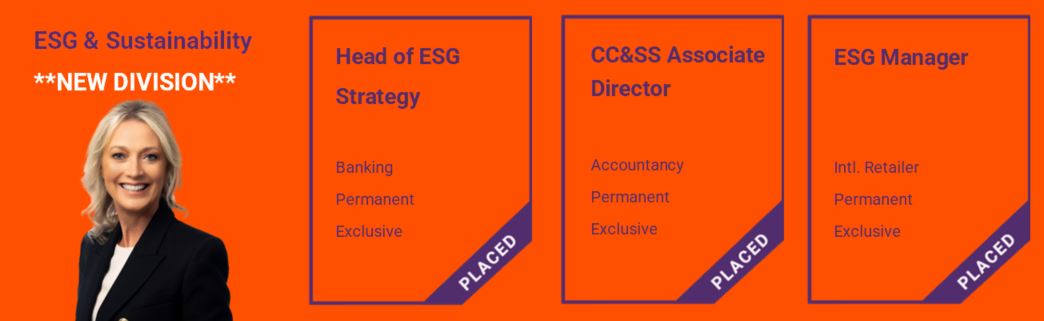

ESG & Sustainability Insights

By Darina Heavey, Senior Recruitment Consultant

ESG and Sustainability:

Hiring for green jobs in Ireland has already doubled since 2016, according to LinkedIn data, and the Government estimates the Irish economy will need to fill more than 20,000 jobs by 2030 just to support leading green economy sectors.

ESG and Sustainability is fast becoming one of the most sought-after skills and in demand roles in the Irish market with a significant number of candidates upskilling in ESG/Sustainability. You just have to look at the availability of new courses in ESG/Sustainability and renewable energy etc by leading universities and educational houses to know, it’s the “in demand” knowledge and experience to have in today’s market.

The Panel established a dedicated sustainability team during 2023 to meet the ESG/Sustainability talent demands of our clients. At a recent event on ESG,a joint venture between The Panel and Change by Degrees (a leading ESG consultancy) we saw over 200 people in attendance, such is the interest and thirst for learning more about ESG and Sustainability. Companies are increasingly recognising the importance of sustainability and are taking steps to embed it into their business operations and strategy. This is leading to a growing demand for green talent who can help businesses achieve sustainability goals. Most firms are now expected to report on their sustainability performance, with CSRD having a significant regulatory reporting impact for financial service companies with the implementation on a phased basis from the start of 2024. The CSRD applies to all large companies in the EU with small to medium listed companies getting an extra three years to comply.

A dedicated section of the company’s management report must include the information necessary to understand its impacts as well as how sustainability matters affect its development and performance. The main objective of CSRD is to deal with the problem of greenwashing where a company makes misleading claims about its ESG standards to gain competitive advantage. Companies must disclose how sustainability issues impact them and how their activities impact the environment. Businesses who are taking action now to incorporate their ESG regulatory requirements into their business processes will gain competitive advantage.

The CSRD reporting will cover the following areas and has specific reporting deadlines. For ESG reporting teams, this is their key focus in 2024!

- Environmental protection.

- Social responsibility and treatment of employees.

- Respect for human rights.

- Anti-corruption and bribery.

- Diversity on company boards (in terms of age, gender, educational and professional background)

At The Panel, we are helping clients build dedicated sustainability teams to meet their reporting requirements. These teams are responsible for developing and implementing the company’s sustainability strategy, tracking and reporting on their performance, ESG regulatory reporting and communicating their sustainability achievements to stakeholders across the entire group.

ESG/Sustainability is the hottest area in recruitment right now in Ireland. We are particularly excited about the opportunities for sustainability professionals in 2024. We believe that this will be a year of significant growth and innovation in the sustainability space. We are also seeing a growing trend of companies investing in really interesting sustainability initiatives, which is creating even more job openings for professionals with the right skills, attitude and experience.

The Panel organises and host a workshop on ESG with Change by Degrees, in collaboration with Green Team Network.

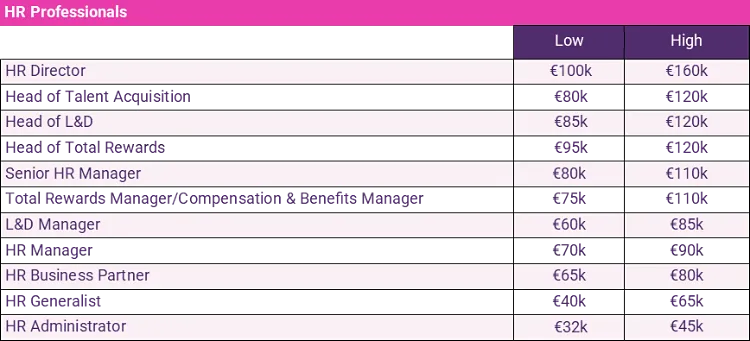

HR & Business Support Insights

By Ailbhe Mullen, Senior Recruitment Consultant

HR & Talent Market:

2023 was a busy year for The Panel’s HR & Talent desk. We successfully filled positions for our key clients that included Head of HR,HR administration, HR Business Partner (Director level), Talent Manager and HR Generalist to name but a few. One area we’ve found particularly busy was employee engagement, our clients being fully aware that engaged employees are more productive, creative, and committed to their jobs. They are also more likely to stay with the organisation in the long term. Hybrid working remained a top request from candidates with almost all looking for a balanced approach.

2023 Trends:

- Rise of AI in HR: Artificial intelligence (AI) is increasingly being used to automate and streamline HR tasks, such as recruitment, talent management, and performance appraisal. AI can help HR professionals to save time, improve efficiency, and make better decisions.

- Emphasis Diversity, equity, and inclusion (DEI) are becoming increasingly important to businesses, as they recognise the benefits of a more diverse and inclusive workforce. Companies are implementing DEI initiatives to create more inclusive workplaces and attract and retain diverse talent.

- Focus on employee experience: Employee experience (EX) is becoming a critical factor in attracting and retaining top talent. Companies are making a concerted effort to create positive and engaging EXfor their employees.

- Investment in learning and development: Continuous learning and development are essential for employees to stay up-to-date with the latest skills and knowledge. Companies are investing in upskilling and reskilling programs to ensure their employees have the skills they need to succeed in the workplace.

- As with many other areas, talent shortage is making it more difficult than ever for companies to find and hire suitable HR professionals. This is driving businesses to take innovative approaches to talent acquisition and retention.

What The Panel expects to see in 2024:

Talent and performance management: HR leaders will continue to focus on developing and implementing effective talent management and performance management systems to ensure that their employees are engaged, productive, and aligned with the company’s goals.

Employee retention: With the talent shortage continuing, employee retention will be a top priority for HR leaders. This will require a focus on creating an engaging workplace, providing opportunities for growth and development, and offering competitive compensation and benefits packages.

L&D:Continuous learning and development will be essential for employee retention and growth.

The Panel’s HR & Talent desk also works with clients across Business Support and can assist you when sourcing for talent such as Executive Assistants, Office Manager and Operation/Business Manager.

The Panel attends IIBN events.

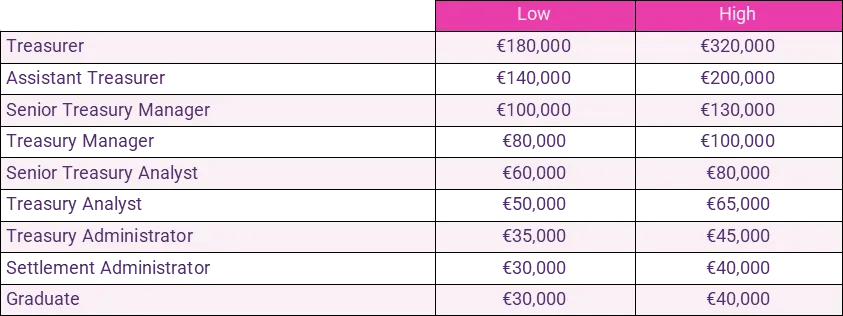

Corporate Treasury Insights

By Alan Bluett, Partner

Corporate Treasury

Recruitment within corporate treasury in Ireland remained robust throughout 2023, with strong demand across multinational treasury centers, shared service centers, and within Irish PLCs. This buoyant market was fuelled by both expansion of existing treasuries in Ireland and the establishment of new treasury centers in the country. As candidates sought new opportunities and increased remuneration, staff turnover increased amidst the favorable recruitment landscape. Demand for treasury professionals remained strong, particularly at the Treasury Analyst level up to Treasury Manager. However, 2023 also witnessed notable vacancies at higher levels, such as Assistant Treasurer and Treasurer. The competitive salary environment within corporate treasury continued to intensify in 2023, with average salaries experiencing significant growth of between 8% and 12%.

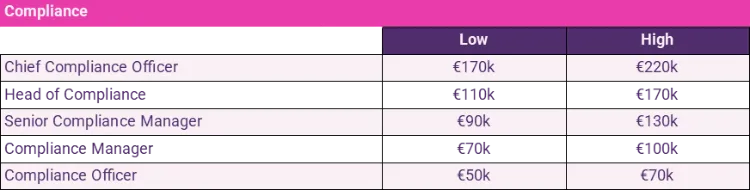

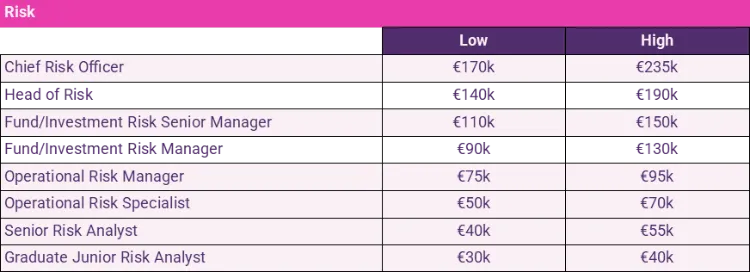

Risk and Compliance

Risk and compliance teams in Ireland continue to expand rapidly to keep up with the ever-increasing volume of new regulations and regulatory oversight imposed by the ECB and Central Bank of Ireland. Candidates with prior PCF approval remain the top choice for new hires, but the demand for risk and compliance professionals remains strong at all levels. In 2023, there was a noticeable increase in resistance from senior candidates to SEAR (Senior Executive Accountability Regime), with a growing minority expressing concerns that the potential downsides of SEAR outweigh the benefits of taking on such a role. We anticipate that the demand for experienced professionals in risk, particularly compliance, will remain robust throughout 2024. Salaries in the risk and compliance sector rose by between 7 and 10% in 2023.

Corporate Banking

Corporate banking in Ireland experienced a relatively subdued year in 2023, characterized by minimal staff movement and a lack of expansion initiatives from both domestic and international players in this domain. The substantial increase in interest rates throughout the year played a significant role in this trend, and we anticipate a similarly static outlook for 2024. Average salaries in corporate banking rose between 4 and 8% during the year.

The Irish retail banking landscape now encompasses just three key players: AIB, BOI, and PTSB. These institutions have reaped substantial benefits from the recent surge in interest rates, which has led to a corresponding expansion in their net interest margins. Recruitment efforts within retail banking have primarily focused on IT, operations, risk, and compliance roles, with average salaries increasing between 3 and 6%.

The Panel attends PRMIA Ireland events.

Industry Executive Summary

By Paul McArdle, Joint Managing Partner

The Panel takes part in the annual Ireland Gateway to Europe trade missions to the US.

Overview – Finance recruitment in industry

2023 started slowly in the recruitment market in general. From our conversations with clients, candidates, and competitors, it seems that the doom and gloom around tech. layoffs at the time impacted confidence in the jobs market.

2022 was a frothy year for all recruitment, including finance recruitment. The Panel finished 2023 on par with 2022, something we did not envisage at the end of Q1! Q2 was a big improvement, and Q3 and Q4 saw a ramping up in activity as confidence returned to the market.

Talent Pools

Our clients are now more open to the talent pools they source from. We have been pushing the “grey market”, candidates aged 50 and over who are great value, capable, and loyal. Ageism is much more prevalent than sexism in the market, and the “Over 50s” is a talent pool that some clients have dismissed too easily. The clients we have partnered with and placed more experienced candidates with are getting more bang for their buck.

More of our clients have accepted hybrid working as here to stay. Accountancy is a profession that lends itself well to hybrid/remote working. In the following pages, you can see our comprehensive Sentiment Survey, which covers this topic comprehensively. Clients who need people to work on-site full-time are fishing from smaller talent pools.

With remote working, candidates with disabilities/mobility issues are more accessible as a talent pool, which is very good. We are also seeing clients looking internally first to see if their talent demands can be met in-house. Sometimes, internal promotions lead to our clients recruiting at a lower level to backfill roles at a lower level than they envisaged when they started the recruitment process.

Travel

As in 2022, 2023 was the year of travel. Pre-Covid, it was traditional that newly qualified accountants would travel to Australia/Canada for their year out. That is still happening. However, there is a “backlog” of recently qualified accountants who missed out on the travel experience, and some are also travelling now. This makes some financial accountant/manager roles harder to source for.

Counter offers

As happened in 2022, more of our candidates were counter-offered. This reflects the demand for talent and more companies being desperate to hold onto what they have.

Losing a candidate to a counteroffer can be particularly frustrating for clients who invest a lot of time and effort in running a proper recruitment process. It is something to be cognisant of in 2024, also.

CFO Market

Counteroffers are not just the preserve of the more junior roles either. The demand for strong talent at the finance director/CFO level is on a par with 2022. In 2023, we continued to partner with PE firms looking to source executive finance talent for their various investments. We also worked with more owner-managed businesses in 2023, often with owners who are looking to scale a business for a liquidity event and need financial rigour introduced/enhanced in their business.

CFO rewards

Another trend from 2022 that was maintained in 2023 was the prevalence of LTIPs (Long Term Incentive Plans) as part of the CFO remuneration package. We have found this with both PE backed companies and also with entrepreneurial companies looking to scale for sale. Something to keep an eye on in 2024.

Summary

The finance recruitment market is in rude health. It is still a candidate led market, however, not as frothy as it was in 2022. Salaries are going up, but not at the same rate.

Candidates are still gravitating towards employers with more flexible work arrangements, and the speed to hire is getting shorter as we are still in a candidate-short market. Clients that are more open to sourcing from different talent pools will find attracting finance talent easier.

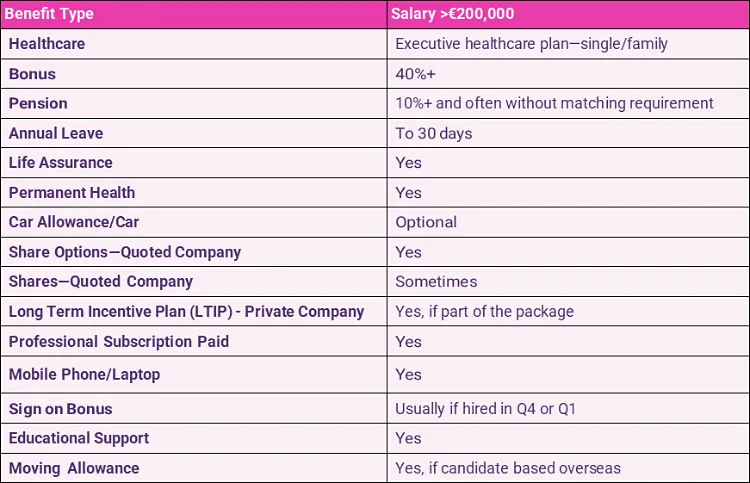

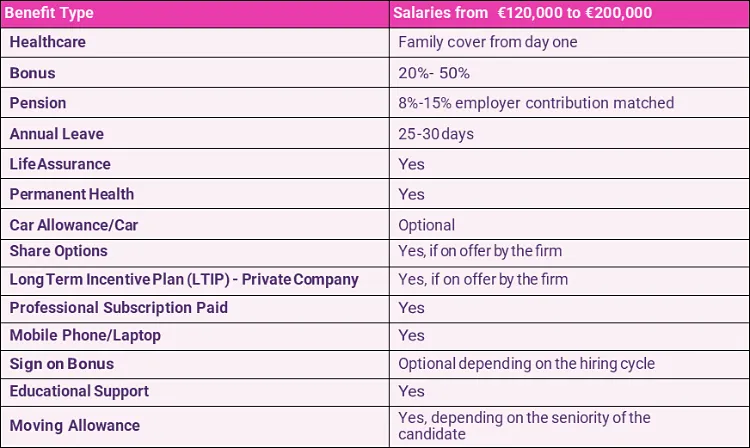

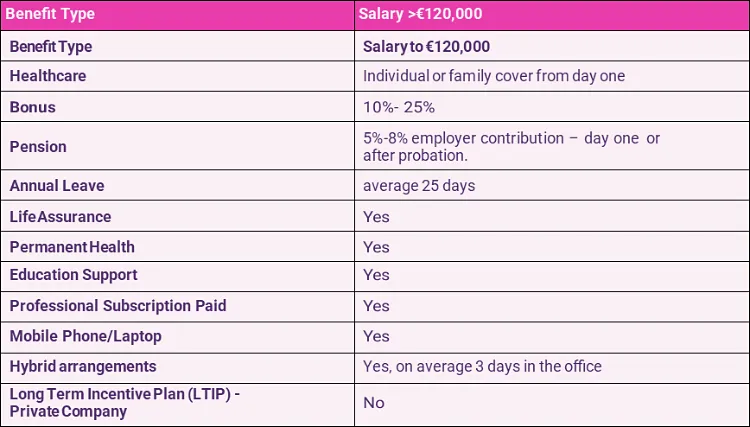

Benefits package:

The Panel sponsors and participates in the annual Calcutta Run, a charity event organised by the Law Society of Ireland,

Candidate Sentiment Survey

The Panel runs a Candidate Sentiment Survey to assess candidates’ attitudes to certain topics.

- 2158 candidates completed the survey.

- The candidates surveyed were from junior management to “C” suite level across the IT, finance, accounting, legal, HR,and ESG professions.

- The candidates were presented with a multiple-choice answer for every question, bar question one, where they chose every answer applicable to them.

- Where the same question was asked in our Autumn 2022 survey, we provide a comparison to Autumn 2023.

- The survey had a “free text” box at the end, and over 10% of the candidates chose to give us their observations on certain topics.

- Their observations are under the relevant questions in italics, and we have purposely given them a voice; this is their survey.

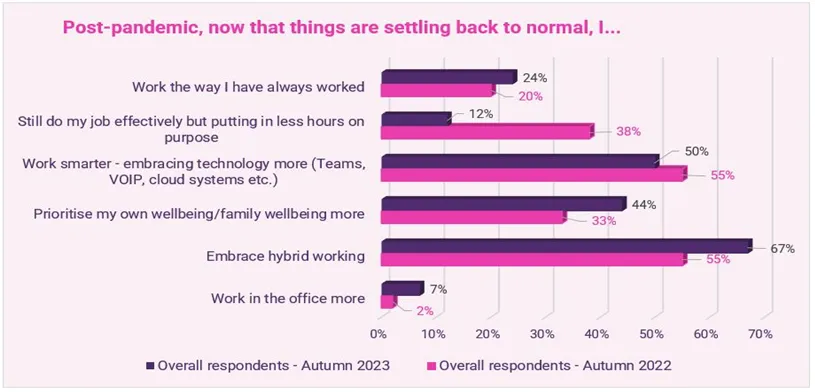

Post-pandemic, now that things are settling back to normal, I…

(Respondents clicked all that where appropriate) 2,106 out of 2,158 people answered this question.

Comparing the responses to the same questions from Autumn 2022, more people are working the way they always worked and are back doing more hours.

As the hybrid market is maturing, we see a 20%jump in those embracing hybrid working (67% from 55%). In tandem, over three times as many people are working in the office (7% from 2%), albeit coming from a low base. Many respondents who do hybrid seem to be spending more time in the office than before while still WFH.

Interestingly, a third more (44% from 33%) are prioritising their family and wellbeing; respondents seem to be more aware of wellbeing, a legacy of COVID living it seems.

From the respondents’ comments below this question and others, you will see a variety of reasons for this.

“I think people like me who did the rat race for 20 years prior to COVID-19 will not return to 5 working days in the office.”

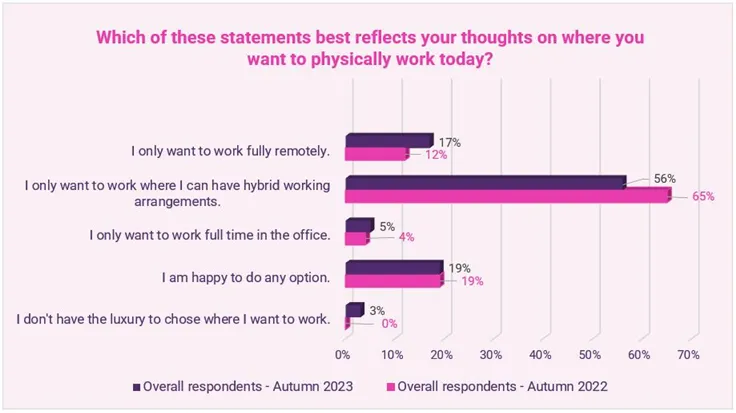

Which of these statements best reflects where you would like your place of work to be today?

2,094 out of 2,158 people answered this question.

This question concentrates on where the respondents themselves want to work if it was their choice. Many of the answers to these questions remained consistent from the previous year (the last question was not asked in 2022). There is a significant upsurge of 40% (17% from 12%) who only want to work fully remotely.

Conversely,the number of people who would elect to work in a hybrid fashion has fallen from 65% to 56%, while working full-time in the office saw a 25% jump, albeit again from a low base, 4% to 5%. This suggests that the desire of respondents to move from hybrid to remote is something we need to keep an eye on.

“Businesses must give the option to full remote work from ANYWHERE not just the country they mainly reside. The mentality must change.”

“My thoughts on WFH are that it should be driven by the function that is performing the work; some functions lend themselves more easily to a hybrid balance than others. It is also very important for junior talent to feel the culture/environment of a company, as this is not something that can be experienced online over a sustained period. If companies are looking for tenure from their employees, then this is something that comes with time and relationships with their team and the management of an organisation.”

“I used to travel 2.5 hours each way for many years. I was always tired and had no time for myself or my family. Well before COVID, I had an arrangement to work from home some days. Then after the beast from the east, I worked from home all the time and only went to the office maybe once a month… my management at the time was so happy with this as my work was done as well as before, and I am also able to help others out when they need me.”

My employer...

2,044 out of 2,158 people answered this question.

Over half the respondents are allowed to choose when they can work in the office, with a third of employers mandating set days to be in the office. Less than 10% of employers insist that people return to the office full-time; anecdotally, we hear this trend is rising. Other businesses operate fully remotely, albeit at a low figure of 3%.

“An employee starting out in their career probably feels the need to engage more face-to-face in an office environment, whereas a working parent finds the challenges of a commute more stressful. Balance is key, and finding the balance that works for you is important. Employers should embrace people who are different with varying demands on their time.”

“Personally, it’s about flexible hours in the office instead of home/office hours. My view.”

“Employers trying to increase engagement and presenteeism feel like a desperate ploy to tie employees to the work and save the value of their buildings.”

“I am 50. Mostly remote works for me, but I think it must be very difficult for younger employees starting out. So much is learned in an office environment by osmosis! Older workers need to remember that they were mentored and helped, and they need to do the same for this generation of young workers.”

“Some employers seem to be squeezing employees for a return to the office. However, work flexibility is key right now, especially for those with children and then to be the more experienced staff members and harder to replace.”

“In the last 4 years, I have worked nearly exclusively at home, in an organisation with nearly 6,000 employees.”

“In the last 4 years, I have worked nearly exclusively at home, in an organisation with nearly 6,000 employees.”

“Despite efforts to the contrary, I think working from home, either exclusively or through hybrid working arrangements, is here to stay.”

“Working from home must be measured. Young employees may have difficulty putting in 8 hours working at home. Employers must be responsible.”

“Employers need to be more flexible with hybrid working to attract & retain talent. Also, salaries need to be reviewed with rising costs.”

“I generally work with and manage what would be considered a “younger generation” of employees. I feel there would be a broader divide between my opinions on the questions in this survey (I’m in my mid-50s now) to, say, the 25-35 age bracket of office-based professionals.”

“I think there is a strong generational/age aspect to the want to be in the office or not, but it may end up being a different career trajectory for them; only time will tell.”

“Working from home shows a company is flexible.”

“IT workers have no reason to be in the office.”

“Managers feel very threatened by the Hybrid environment.”

“I think people need to work in the office at least 2 – 3 days per week. So much is learnt at the “Water-cooler” and having coffee/lunch with people. It also helps individuals grow in an organisation. For me personally, I am happy with Hybrid, although if I take on a new job in a new organisation, I think it would be more beneficial, at least in the short term, to spend as much time in the actual office as possible, provided others are there also.”

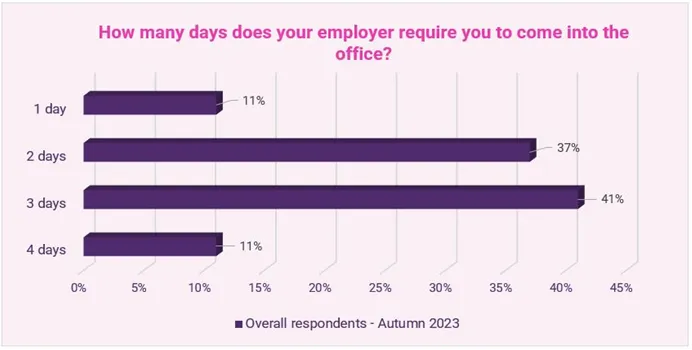

If you do hybrid working, how many days does your employer require you to come into the office?

(Respondents who answered the previous question with the answer hybrid, then answered this supplementary question, hence no 5 days (full time) in the office option). 717 out of 2,158 people answered this question.

There are no real surprises here; most of our clients offering hybrid work options have their teams in two or three days in the office. That over one in ten employers are looking at four days on-site is a trend to keep an eye on, especially when you add it to the 8% in the office full-time, so one in five employees are back working in the office a minimum of four days a week.

“Personally, I like going into the office a few days a week (I love the flexibility of 1-2 days WFH), but I think a lot of companies are slowly shifting away from hybrid models.”

“I work in the office 4 days; we are required to do 3, but with people choosing their WFH days, it’s hard to get people together for meetings, and even if in the office, it’s still Zoom meetings. I would prefer in-person meetings as they are more productive. On Zoom, people are distracted and are doing other things.”

“I try to focus more on the outcome/productivity of my team and not focus on the where so much.”

“Mandatory 3 days in office with 1 anchor day but I pick and choose the 2 days to juggle family commitments. I have a short commute in Limerick with plenty of parking so the RTO not really impacting me.”

“My sense is the balance shall revert to employers in the next six months. This may result in more employers requesting employees to be on site full-time. Employers may be underestimating how this might impact their ability to retain and hire.”

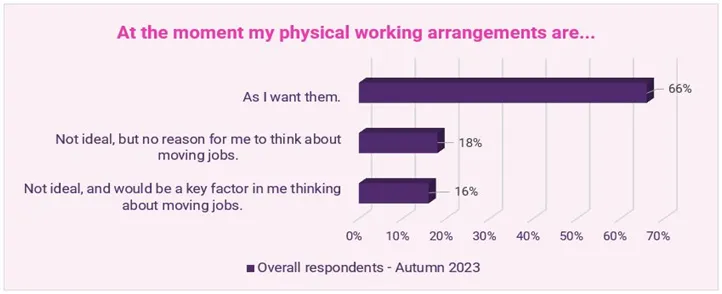

At the moment my physical working arrangements are…

2,043 out of 2,158 people answered this question.

That one in every six respondents are looking at their physical workspace as a reason to go on the jobs market is something employers need to be cognisant of. Particularly relevant if employers are mandating a return to the office.

“My preference for WFH is driven by being able to afford to buy what I want in Dublin, so I will be moving to Wicklow/ Wexford. I will still go to the office as needed.”

“I believe that work-life balance is crucial for organisations success however, somehow, most older managers don’t want to accept it.”

“I believe that work-life balance is crucial for organisations success however, somehow, most older managers don’t want to accept it.”

“Employees want to work in a meaningful manner. To get the best out of them they need to be treated like adults. Autonomy, responsibility, and trust are key. If I don’t get those I move on.”

“The balance re workload has shifted, hybrid working has led to an out of sight out of mind attitude. Those in the office do more and are asked to do more.”

“Always be open to hearing feedback from your employees, and if mandating people back to the office for collaboration, ensure senior management applies to that also. I was remotely managed and had to bring all my teams back, and not once physically met my own direct management team.”

“In my view, the option to WFH is essential and would be one of the top three considerations if I was changing employment. Currently, my employer allows 2 days per week, but I would prefer 3.”

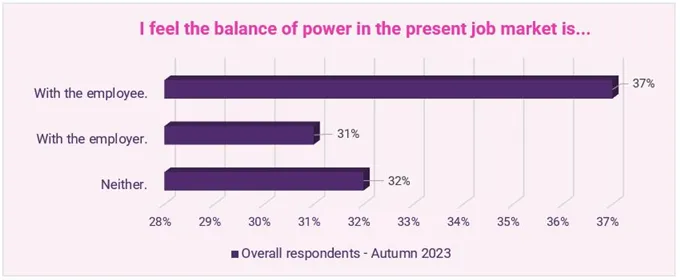

I feel the balance of power in the present job market is…

2,041 out of 2,158 people answered this question.

Most respondents feel that the balance of power is still with themselves, the employee. That less than a third think the balance of power is with the employer is noteworthy. Anecdotally, we believe this number will rise as the jobs market begins to soften.

“There is definitely a change of circumstances when speaking with friends and their working arrangements post-pandemic…”

“My company were one of the first back in office and it’s strictly 3 days which is not ideal. It almost feels like being treated like children.”

“Working remotely or in a hybrid situation is fine if the employer trusts his employees. When that trust breaks down and the employee is tracked through his computer program as to how long he is working then that trust level has gone and is detrimental to the company and overall business…”

“Companies need to establish online training for all employees on how to manage communication remotely, discipline on meetings online, effectiveness and reporting that is necessary. Rebuttals regarding forcing employees to be in the office needs to consider the travel, sustainability, and efficiencies of forcing employees to work in the office. If the role is desk based, it’s hard to understand the sustainable and operational costs benefit of maintaining an office which is hardly populated when hybrid or remote working is in place. Additionally, the property challenges companies need to consider holding valuable office space in cities when employees need accommodation, particularly when a company operates a hybrid/remote working model, that giving up the property to residential use is a real need in cities to re-populate the centres and cultural needs.”

“Companies need to establish online training for all employees on how to manage communication remotely, discipline on meetings online, effectiveness and reporting that is necessary. Rebuttals regarding forcing employees to be in the office needs to consider the travel, sustainability, and efficiencies of forcing employees to work in the office. If the role is desk based, it’s hard to understand the sustainable and operational costs benefit of maintaining an office which is hardly populated when hybrid or remote working is in place. Additionally, the property challenges companies need to consider holding valuable office space in cities when employees need accommodation, particularly when a company operates a hybrid/remote working model, that giving up the property to residential use is a real need in cities to re-populate the centres and cultural needs.”

“My current employer is firing people for not being in the office enough. They are very inflexible. A death in the family was not a good enough excuse for not making office day target. People are leaving because of their hard-line, which I believe is what they want.”

“My current employer is firing people for not being in the office enough. They are very inflexible. A death in the family was not a good enough excuse for not making office day target. People are leaving because of their hard-line, which I believe is what they want.”

“I really think 2/3 day hybrid model is the best of both worlds, it allows you to connect to colleagues but also gives downtime to work on reports and do small things like accept couriers. I think a more even balance of power is what’s needed. The best workplace is where there is open communication and collaboration between employers and employees. Both sides need to feel listened to and their point of view understood, and this is an ideal opportunity for the good employers to rise above and make themselves known and attractive to the best candidates.”

“Pressure on employees has increased in 2023. Companies dictating number of days in the office has caused a lot of dissatisfaction amongst employees.”

“Career challenges are about companies cutting cost in favour of shareholders return. There is work, there is justification for positions, however there is limited budget.”

“Some employers seem to be squeezing employees for a return to the office. However, work flexibility is key right now especially for those with children and then to be the more experienced staff members and harder to replace.”

“There’s an imbalance in how the same employer treats different employees regarding remote working.”

“Salaries must increase. Retention will become an issue otherwise.”

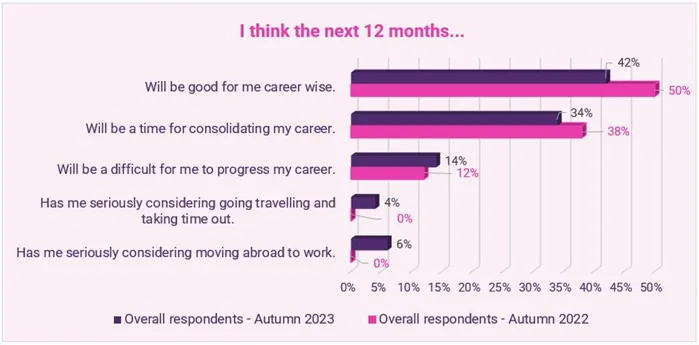

I think the next 12 months…

2,029 out of 2,158 people answered this question.

Overall, candidates are more downbeat on their career prospects compared to 12 months ago. Less than half of them think that the next 12 months will be good for them career-wise, a fall of 16% (50% to 42%). Over one in ten is worried about their career progression, while the 10% thinking of taking time out or travelling/working abroad is a higher number than we expected.

Please note that we did not ask the last two questions in our Autumn 2022 survey, so no comparison figures are available.

“Not sure what consolidating my career meant exactly, but I took it as considering opportunities/options!”

“Compensation gap between newly qualified and experienced needs to grow.”

“Increasingly I am finding that age as opposed to work preferences or competence are becoming an issue.”

“Hiring process is unnecessarily complex and overly demanding. Good candidates are being overlooked or end up burnt out by the multiple interviews, presentations and assignments. The expat community are returning and while they may be considered as not having Irish experience or even worse “being overqualified”, they bring valuable skills and an international and growth perspective but are dismissed because of aforementioned reasons. Overqualified is the last true discrimination used by employers and it is pathetic.”

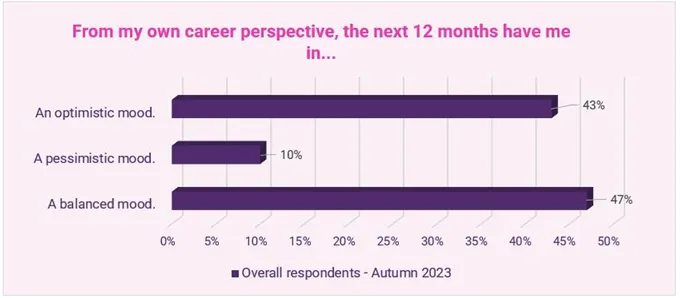

From my own career perspective, the next 12 months have me in…

2,045 out of 2,158 people answered this question.

Overall, the mood music is good, with only one in ten of the respondents in a pessimistic mood. This is a good barometer to follow. It will be interesting to see how the trend unfolds in future surveys.

“I have stopped working since May 2022, and home working enforced by the pandemic response was the catalyst for me. On balance, it’s more destructive than helpful, in my experience, and I have spoken to many people whose experience was the same.”

“Business environment for certain sectors will be very tough over the next 12 -18 months.”

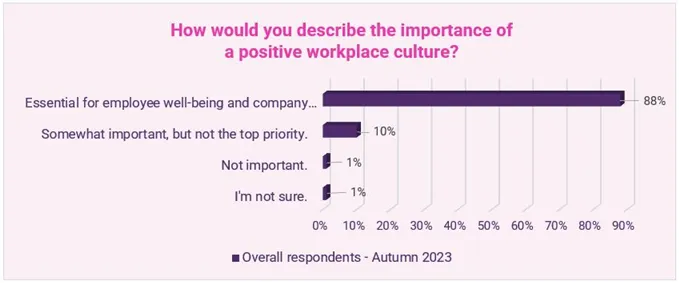

How would you describe the importance of a positive workplace?

2,031 out of 2,158 people answered this question.

That nine out of every ten respondents put a high value on workplace culture is something all employers need to note. The respondents clearly link workplace culture to the success or failure of a business. There is huge “buy-in” from candidates, and companies who foster a positive work environment and culture will retain/attract talent more easily.

“I feel things are still a little polarised. On the one side you have companies who see in-person being critical to culture and performance and on the other end of the spectrum, a portion of employees seeing flexibility as their main priority.”

“I feel things are still a little polarised. On the one side you have companies who see in-person being critical to culture and performance and on the other end of the spectrum, a portion of employees seeing flexibility as their main priority.”

“Pre-pandemic cultures are creeping back in. Perhaps worse – an expectation to be always on and always available. No consideration for working parents and the difficulties on childcare, cost of living, housing. Insistence on working in office, when it’s not an efficient use of time, is not motivating or helpful.”

“Enforcing a 3-day RTO policy is out of touch, especially considering the impact of inflation on commuting expenses. It’s unfair to mandate RTO for everyone when not all employees need it. If the issue is related to company culture, then it’s more appropriate to allocate budgets for team building and other EVP initiatives. RTO is not the solution to a culture problem, as it’s often deeply rooted.”

“There should be frequent social events in case of hybrid working. Further, there should be designated days for teams so that teams can connect in person.”

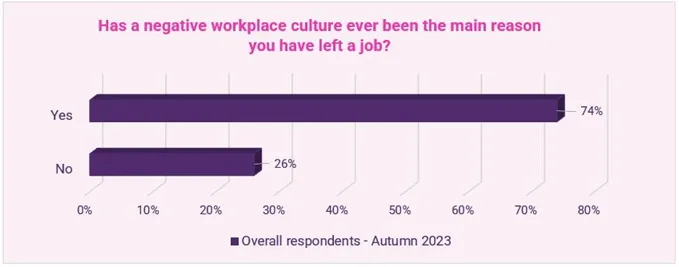

Has a negative workplace culture ever been the main reason you have left a job?

2,024 out of 2,158 people answered this question.

We believe in the saying, “You don’t leave your job; you leave your Manager”. A lot of negative workplace cultures are the fault of the leaders within the business; sometimes, it can be just one overpowering presence. That said, three out of four respondents left a role because of a negative culture, which is much higher than we envisaged.

“Employers continue to pay lip service to culture, inclusion, diversity etc. Not so much from an LGBQ perspective but more from an appreciation of opinion, background, experience etc. Will definitely be leaving my current role due to the above.”

“Being connected is not really a function of remote vs in office. It’s about management and culture of the staff. Bad management is just amplified a bit by being remote.”

“The sense of belonging can be difficult to achieve in fully remote working. It takes more effort to instil culture, but it is crucial for success.”

“While the hybrid working model has offered great options in workplace norms, management must be careful that negative organisation behaviours become established do the detriment of culture, equality and inclusion.”

“In general companies need to accept the new norms and understand that culture can still be proactively driven in a positive way. Connectivity is important but needs to be a priority and front and centre with the leadership team.”

“The most important asset within an organisation is its people!”

“Culture of a business is based off our interactions. Productivity is now viewed on time in the office together.”

If you work in an office less than 2 days per week, do you find it more difficult to connect with the culture of your organisation?

1,904 out of 2,158 people answered this question.

One of the questions we were keen to ask was about company culture and the possible disconnect that people may feel from being in the office for two days or less. Interestingly, over one in four respondents feel disconnected; we were expecting this figure to be higher. This question was one that generated a large organic response, with some interesting observations from the respondents below.

“Difficult to get colleagues back to the office, a definite drop in connection.”

“Workplace cultures can be very complex these days, often obscured by political correctness and a tendency for certain behaviours and prejudices to be hidden from plain sight. Genuine openness and transparency are thus increasingly rare.”

“I feel working fully remotely is not beneficial. In terms of building relationships with colleagues, some in-office time is important. A minimum of one day a week.”

“Culture is a word thrown around but rarely defined by companies. Most use it as a generic term to force an agenda or change, returning to an office for no reason, as an example. It’s usually set by people at a level who are quite disconnected from the general workforce, so they don’t actually know what they are talking about. I’m a big fan of promoting and embracing culture, it’s just done terribly, and no amount of pizza & beer in a dreary IFSC building will change that.”

“Likely that many firms will continue to ask employees to go back to the office, not just for culture but also so that graduates can learn from experienced employees.”

“Ensuring a good work culture while using hybrid working lies mainly with the employer.”

“I feel connected to the culture remotely because I’m with the organisation for a long time, which may not be the case if I’d just started or was with the organisation for a short period.”

“The issue of hybrid working and how that is most effectively deployed in organisations is yet to reach a full conclusion. While remote working is valued by employees in being more time efficient and effective in use of time, the necessity of in-person attendance is increasingly becoming recognised. In-person attendance is essential to fostering workplace culture, brand loyalty and safeguarding the long-term wellbeing of employees by providing social and networking opportunities for support and to avoid burnout.”

“While I feel connected to the culture of the company, I understand that a remote set-up makes it harder to bring people into the team and the culture.”

“I believe if hybrid working is to work well, they’re needs to me effort on the part of the employee to connect with corporate culture. It’s not going to happen as organically as when you are full time in the office.”

“In my current role I manage teams in the US & EMEA. Technology is a priority for me in ensuring a unilateral management approach across both regions. That being said, my experiences & driving developmental factors are coming from the US which don’t serve me in applying for new roles outside of my current company, but I struggle a bit with the personal relatability with my US teams as I can’t meet them in the office.”

“As a contractor, I have mostly noticed HR and People Teams have become disconnected from their workforce. Lunches, merch, etc are not what people look for. Vision, roadmaps, product strategies, etc. is what makes them excited.”

We would like to thank all the respondents for filling out the survey.

Special thanks to those who chose to add comments; these were particularly illuminating.

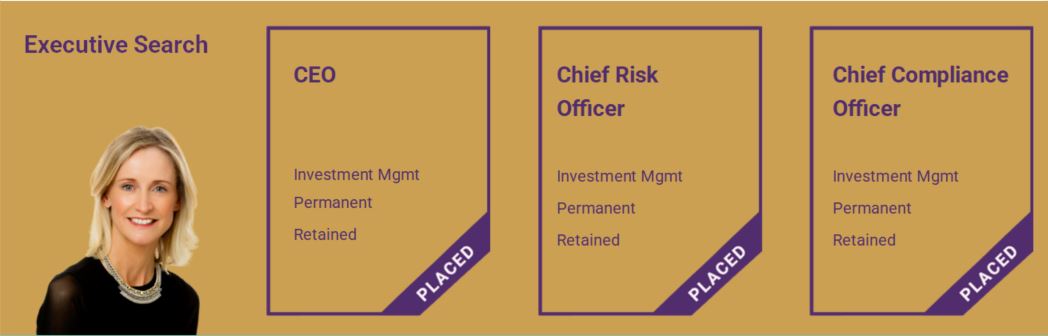

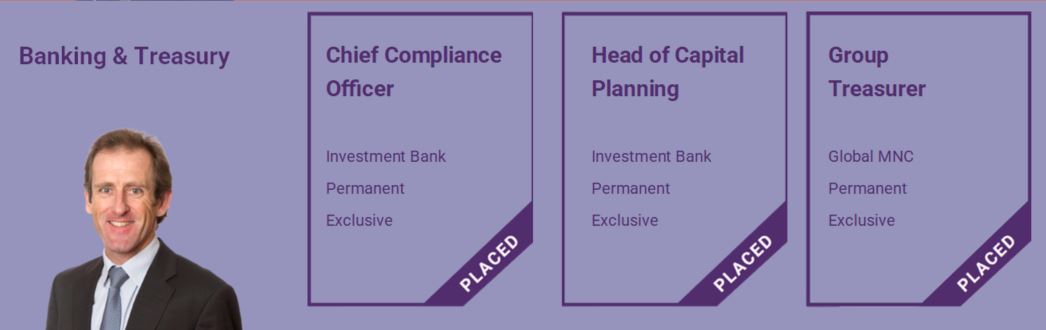

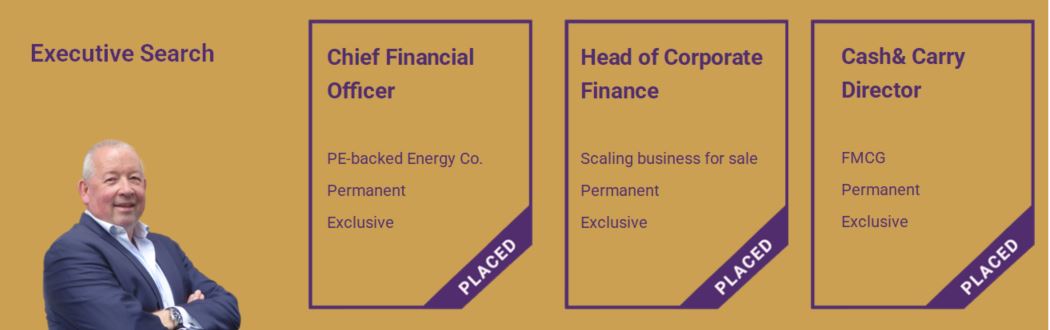

Executive roles placed in 2023

Your Funds & Investment Management Partners

Anne Keys, Joint Managing Partner

Anne Keys, Joint Managing Partner

t: 01-6377088 | e: anne@thepanel.com

Anne Keys leads The Panel’s executive search in the Funds and Investment Management sector and is uniquely placed to partner with firms in hiring executives, board members , and independent non-executive directors.

Anne works with a large number of investment firms establishing a presence in Ireland following the Brexit vote and has had great success sourcing Country Heads/CEOs, PCF, and DP roles for her clients.

Anne’s key differentiator is her extensive network developed over 25 years in recruitment and her technical knowledge of the roles she recruits for, in the funds and investment management space. She provides consultancy advice on the talent landscape, and talent availability and is hugely knowledgeable on the sourcing requirements driven by the CBI under CP86.

Anne was instrumental in the setup and launch of 100 Women in Finance in Ireland and she recently completed her term as Co-Chair of the steering committee in Dublin and is now an advisor to the committee. She is driving 100WF workshops for their executive female members, advising them on how to launch their independent non-executive director careers.

Anne has been invited to speak at key industry conferences in Dublin, London, and Amsterdam on “CP86 Dear Chair – Getting the plan right”, “The talent landscape in the Investment Management Sector in Ireland”, “The War for Talent”, “The benefits of an international board” and “The benefits of a diverse board”.

She also supports basis.point, the Irish Fund industry’s initiative to come together to help make a difference to those in need.

Liam Murphy, Director

Liam Murphy, Director

t: 01-6377027 | e: liam@thepanel.com

Having previously worked in the Funds industry for 5 years Liam joined The Panel’s Funds & Investment Management division in July 2013 and has since been promoted consistently within the business to his present role as Director in May 2023.

In his role, Liam specialises in the recruitment of roles between Manager and C-Suite/Executive level on behalf of various financial services entities including Asset Managers, Reg Tech and Fund Management companies based in Ireland and overseas. Liam has strong industry knowledge, and he has worked on roles and placed candidates at all levels of multiple operational areas including Transfer Agency, Fund Accounting, Compliance, Trustee, Custody, Middle Office, Risk, Distribution, Regulatory, Depositary, Data, Operational Oversight, Sales as well as other niche areas.

Outside of servicing multiple PSL clients in these mentioned areas simultaneously Liam has also exclusively assisted firms looking to set up their Operations in Ireland from scratch as well as helping entities looking to relocate roles from other European and Global locations by providing expert knowledge of the designated operational area as well as insights on talent availability, salaries and local market trends. Liam’s “root and branch” recruitment approach and his ability to tailor each solution to suit his clients individual needs has meant he has a proven track record of providing exceptional talent at all levels in this sector. Liam graduated from the University of Limerick with a BBS in Marketing & Finance (2007).

He also holds a ‘Certificate in International Financial Markets’ and a ‘Certificate in Financial Services Modules’ from the Institute of Bankers.

Darina Heavey, Senior Recruitment Consultant

Darina Heavey, Senior Recruitment Consultant

t: 01-6377015 | e: darina@thepanel.com

Darina covers ESG & Sustainability for Financial Services, Industry and Consultancy.

Roles Darina recruits for include:

Risk, Compliance, AML, CTF, ESG, Sustainability, Fund Management, Banking, Treasury and Insurance.

Andrew Wynne, Recruitment Manager

Andrew Wynne, Recruitment Manager

t: 01-6377052 | e: andreww@thepanel.com

Andrew specialises in Accounting, Finance and Tax for the Financial Services sector.

Covering The Panel’s search in the Funds and Investment Management sector and is uniquely placed to partner with firms in hiring Newly Qualified Accountants to Finance Manager level.

Will Kavanagh, Senior Recruitment Consultant

Will Kavanagh, Senior Recruitment Consultant

t: 01-6377090 | e: will@thepanel.com

Will recruits Risk, Compliance, and Data Analytics professionals within the Funds & Investment and Banking & Treasury divisions.

Roles Will recruits for include:

Risk Officer, Compliance Officer, Investment Data Analyst, Regulatory Data & Reporting Manager.

Farah Daoub, Recruitment Resourcer

Farah Daoub, Recruitment Resourcer

t: 01-6377014 | e: farah@thepanel.com

Farah is a Recruitment Resourcer for our Funds & Investment Management and Banking & Treasury practices.

She supports two partners Anne Keys and Alan Bluett, and this role involves managing and sourcing top-notch talent for both divisions. This includes identifying suitable candidates through the use of The Panel’s leading-edge AI talent sourcing tools, coordinating interviews, streamlining onboarding procedures, conducting reference checks, and engaging with clients on behalf of the partners.

The Panel - DE&I and Sustainability

Sustainability

As time moves on the sustainable responsibility of employers are becoming more and more important, therefore we here at The Panel take great pride in doing our best in meeting our target in this area. We take responsibility for our candidates, clients, and every part of our business in order to offer and supply solutions that positively impact those around us.

As time moves on the sustainable responsibility of employers are becoming more and more important, therefore we here at The Panel take great pride in doing our best in meeting our target in this area. We take responsibility for our candidates, clients, and every part of our business in order to offer and supply solutions that positively impact those around us.

Knowing that you are partnering with a responsible organisation, should offer you peace of mind.

Read more on our Sustainability Policy here.

Diversity, Equality & Inclusion (DE&I)

In The Panel we actively focus on sourcing talent through a DE&I lens – we know diverse teams make for better functioning and more collaborative teams.

The Panel and our Managing Partner Anne Keys were instrumental in the setup and launch of 100 Women in Finance in Ireland in 2017, she acted as Co-Chair for 100 Women In Finance Dublin location for one year, and is currently driving 100WF workshops for senior practitioner members, advising them on how to launch their independent non-executive director career.

In November 2017, The Panel signed up to the Ibec/30% Club’s “Voluntary Code of Conduct for Recruitment and Executive Search Firms Code”.

This Code recognises the importance of search firms and client organisations working together to deliver change based on four principles:

- Strategy & Goals

- Talent Pipeline

- Prices

- Monitoring & Reporting

What can The Panel help you with?

What can The Panel help you with?

Regulations– guiding candidates and clients through the Irish regulatory environment.

Market analysis– updating candidates and clients on current trends.

Talent acquisition– for clients we help source the best candidates for the role at hand.

Advice– we provide our candidates and clients with the most up-to-date information available regarding the market, the recruitment processes and the best remunerative options available to both.

Technology & Resources – offering candidates and clients the most up to date in recruitment and AI technology, enabling a quicker and more efficient recruitment process from start to finish.

As a company The Panel has successfully strived for internal diversity and inclusivity and in doing so we firmly believe that puts us in a strong position to be ambassadors for our clients in an Ireland that is becoming ever more progressive, diverse and inclusive.

- We support groups for women in business e.g. 100 Women in Finance& Women Executives.

- We employ 8 different nationalities with various cultural and religious beliefs.

- We have a higher proportion of female employees.

- We have two joint MD’s at the Panel,1 male and 1 female.

We believe we are one of the most diverse and inclusive recruitment companies in Ireland, putting us in a position to help our clients achieve the same.

We instill the following approach through rigorous training of our employees;

- Equal Employment Opportunity is a fundamental right of all employees and applicants for employment.

- The Panel undertakes not to discriminate unfairly against any applicant in respect of the subject matter of disclosures made pursuant to the pre-engagement screening process or any other information revealed during the engagement process.

- All applicants are provided a full and fair opportunity for employment, without regard to race, colour, religion, national origin, disability, gender,age,sexual orientation, genetic information, or parental status

- We promote equality for all candidates.

- We foster and support a globally diverse and inclusive workforce with our clients and place a high value on diversity and equal opportunity.

- We believe it is important for applicants to be considered for the employment of their choice and have the chance to perform to their maximum potential.

- The Panel is an equal opportunity Employer and Recruiter.