EXECUTIVE

funds & investment

salary guide 2021

funds & investment salary guide 2021

Funds & Investment Management

Financial Services

Author: Anne Keys, Joint Managing Partner

Download the 2021 salary guideView all salary guides2020 in Review:

2020 was an unusual year, one that will go down in history! While hiring was strong in the first two months of the year, when the pandemic hit in early March it put the breaks on hiring for approximately two months. What we did see is hiring in the governance space continue and even in the midst of a lock-down, the CBI wanted PCF and DP roles filled promptly. Candidates felt confident in the sector as they re-signed from roles and this meant we were backfilling for their replacement.

Recruitment in the funds and investment management space in Q4 showed strong signs of returning to normal levels due to strong markets, issuing of the Dear Chair letter (substance requirements) and Brexit.

The Job Market

2021 started off very strong with increased levels of hiring in all areas in Financial Services. The Funds Industry continues to add bench strength to their governance areas and in operations, the focus is on Private Equity Real Estate.

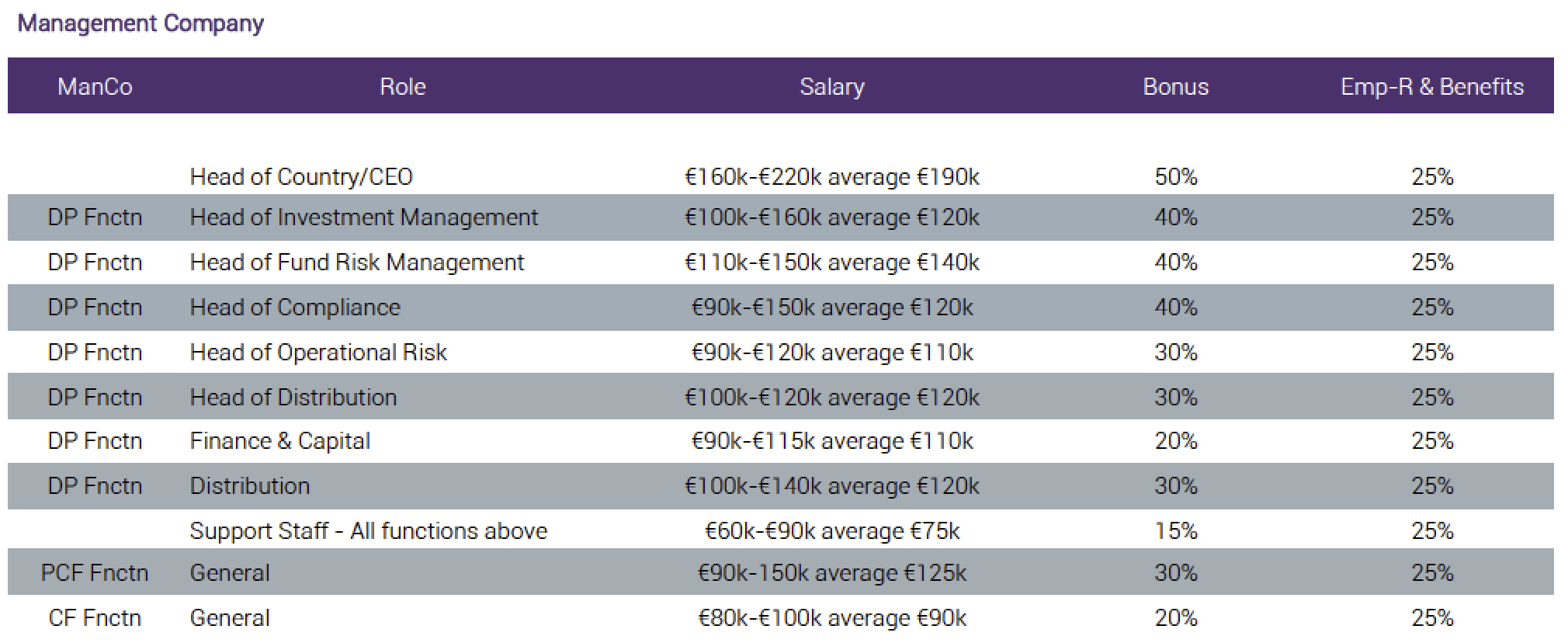

For the Man Co space, the Dear Chair letter and Brexit has increased hiring significantly as firms look to put substance on the ground in Ireland or bring their DP’s in country.

The hottest area of recruitment in the Designated Person’s space is DP Regulatory Compliance, DP Fund Risk and DP Investment Management. The Panel has also won a number of retained assignments to source CEO and Managing Directors for new and established area.

This is very exciting for the executive hiring market where we can present highly attractive executive roles to senior candidates in Ireland and overseas, who are on the move. We believe hiring will continue at a pace as firms present their plans to the board at the end of March and focus on implementing their plans during 2022.

Work from home

Covid has made us rethink how we live and work. One positive outcome from COVID is the willingness of firms to consider and implement hybrid work arrangements. While this is a fluid situation for firms, we are seeing a variety of hybrid arrangements, with most organisations favouring 3 days in the office and 2 days remote. Hybrid arrangements can now be discussed more openly and there is a real focus on making things work for the business and for their employees.

Brexit & CP86

On January 1st, 2021, the United Kingdom left the European Union, under the name of Brexit. It meant that new regulations had to be put in place to better facilitate trade within the EU zone. As the only native English-speaking country in the EU, Ireland took over as a key destination for many markets.

New Fund Management Companies Guidance (‘CP86’) requirements set out by the Central Bank of Ireland (CBI) came into effect in October 2020, supporting the CBI’s commitment to supporting the supervisory framework for effective governance of fund management companies. Resulting in new entrants to the Irish market needing to be aware of additional regulatory guidelines.

Source: Deloitte

Foreign Direct Investment

Ireland, with over a thousand fund managers from over 50 countries worldwide, has proven itself to be a stronghold for FDI investment, UCITS and AIFs, providing not only an attractive tax regime, a large talent pool for firms to choose from, but is also offering full mar-ket access to the EU.

It has a well-established and committed funds industry set up, ready to welcome new assets to the market as they become available. According to findings by IDA Ireland “a total of 18 out of 25 top financial services companies are based in Ireland.

According to Irishfunds.ie “over 75% of the assets of Irish domiciled funds are held in UCITS”, ensuring an unrivalled Irish competitiveness. They also refer to Ireland as the largest alternative investment fund centre in the world, with more than 40% already operating from here. That makes Ireland a highly attractive option.

Referring further to Irish Funds, it can be confirmed that over 60% of the total European ETF market is based here, with the Irish domiciled ETFs representing around 62% of the overall ETF market.

Sources: Irish Funds, IDA Ireland

Asset Management

Though many fund management companies are trying to find their footing after a year like 2020, 2021 is look-ing to be a busy one for industry stakeholders.

In January both the Central Bank and the European Commission released guidelines and results related to research into existing market practises and the end-result was plenty of projected opportunities for the overall market in the months ahead.

In March, all fund management companies were required to update existing fund

prospectuses to incorporate sustainability-related disclosures.

Looking forward it is expected that the CBI will release additional information in relation to the ManCo action plan set out in October 2020, and guidelines in relation to performance fee guidance and cloud outsourcing.

Sources: Dillon Eustace, KPMG, IAIM

Sustainability

As time moves on the sustainable responsibility of employers are becoming more and more important, therefore we here at The Panel take great pride in doing our best in meeting our target in this area. We take responsibility for our candidates, clients, and every part of our business in order to offer and supply solutions that positively impact those around us.

Knowing that you are partnering with a responsible organisation, should offer you peace of mind.

Read more on our Sustainability Policy here.

Diversity & Inclusion

In November 2017, The panel signed up to the Ibec/30% Club’s “Voluntary Code of Conduct for Recruitment and Executive Search Firms Code”. This Code recognises the importance of search firms and client organisations working together to deliver change based on four principles:

- Strategy & Goals

- Talent Pipeline

- Prices

- Monitoring & Reporting

What can The Panel help you with?

Regulations – guiding candidates and clients through the Irish regulatory environment.

Market analysis – updating candidates and clients on current trends.

Talent acquisition – for clients we help source the best candidates for the role at hand.

Advice – we provide our candidates and clients with the most up-to-date information available regarding the market, the recruitment processes and the best remunerative options available to both.

Technology & Resources – offering candidates and cli-ents the most up to date in recruitment and AI technology, enabling a quicker and more efficient recruitment process from start to finish.

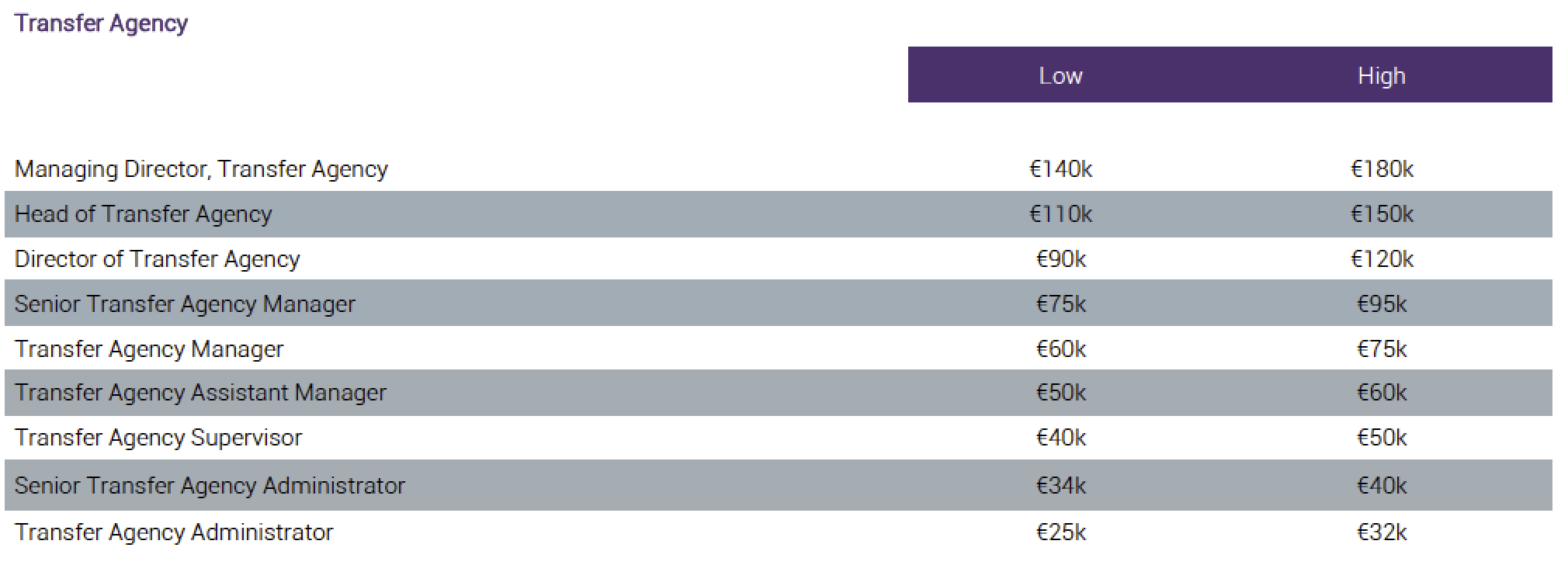

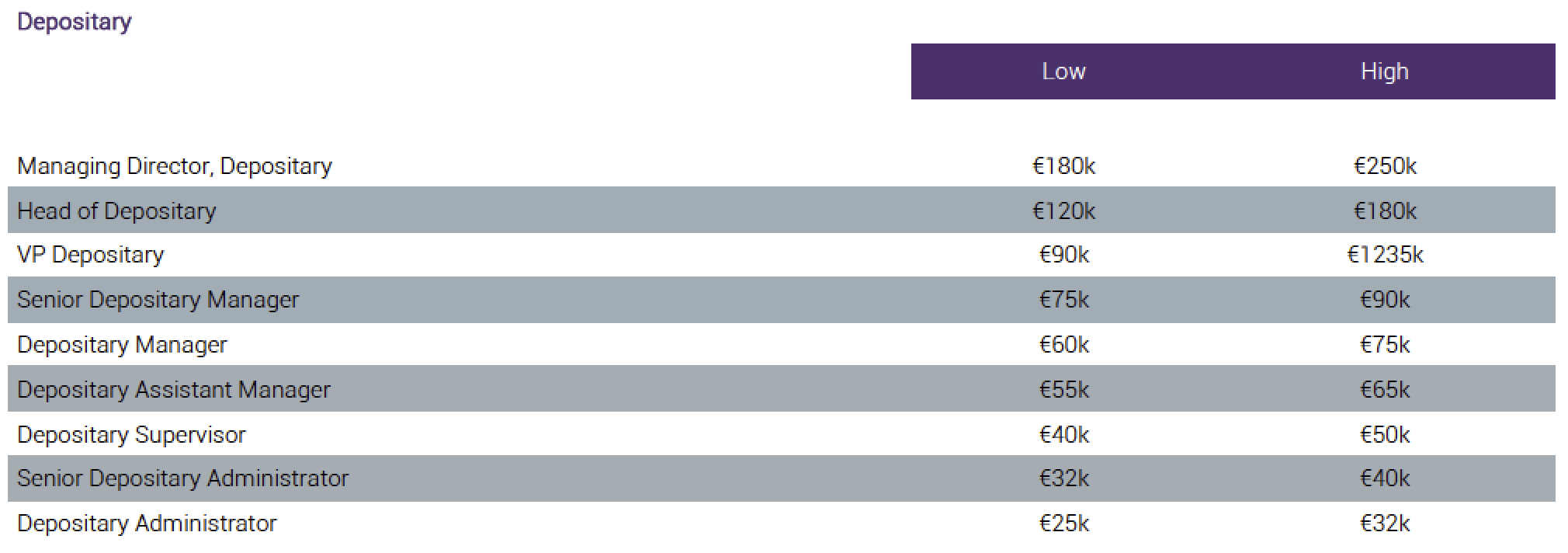

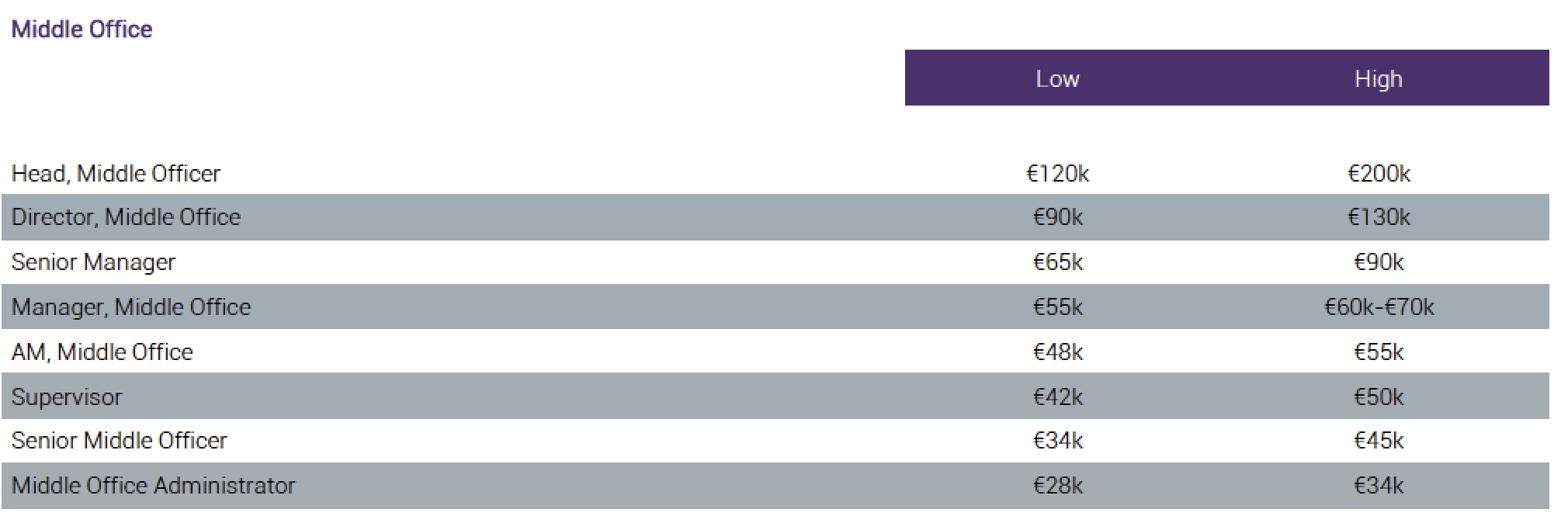

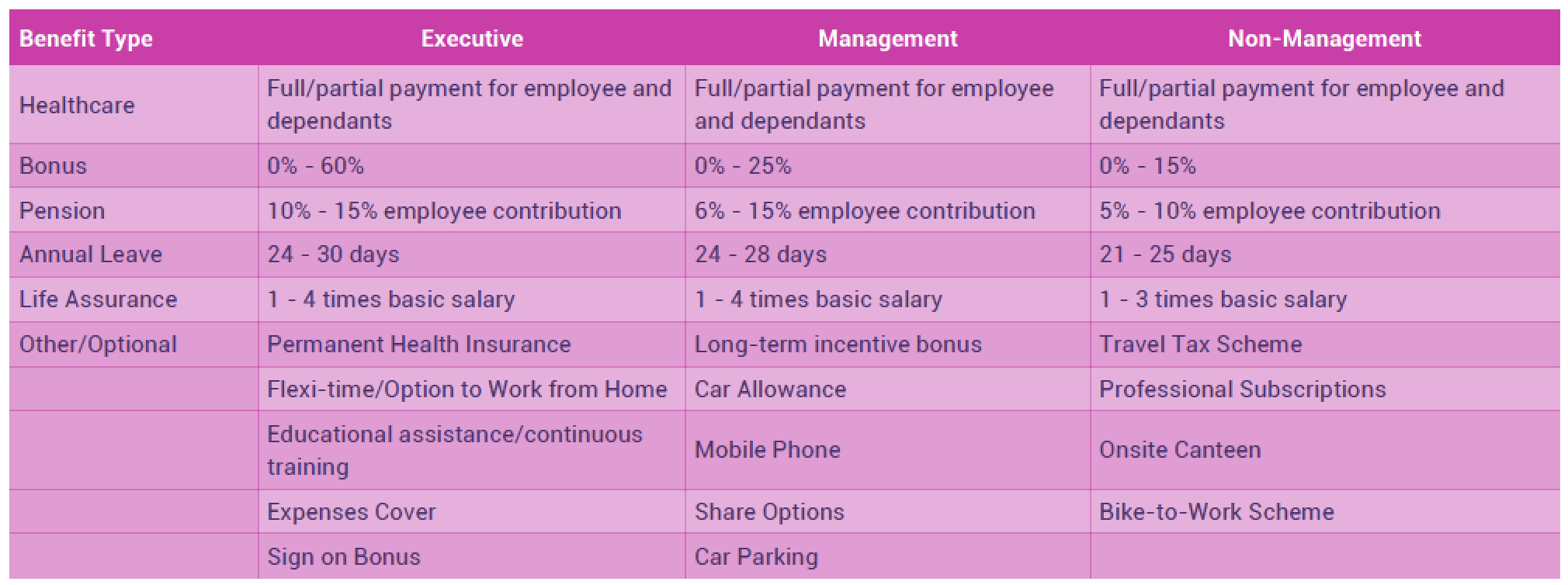

Benefits

Companies providing benefits to their employees are more likely to have higher employee retention rates, lower turnover and a strong talent pool available to them.

These are the key points identified by employees as valued benefits:

- Health Insurance – Tends to vary from company to company, sector to sector but includes; full/partial or membership to company healthcare scheme.

- Performance related bonus and incentives for high performers.

- Pension.

- Education and continuous training.

Employers need to be aware of how important the overall renumeration package is in order to attract and retain their staff.

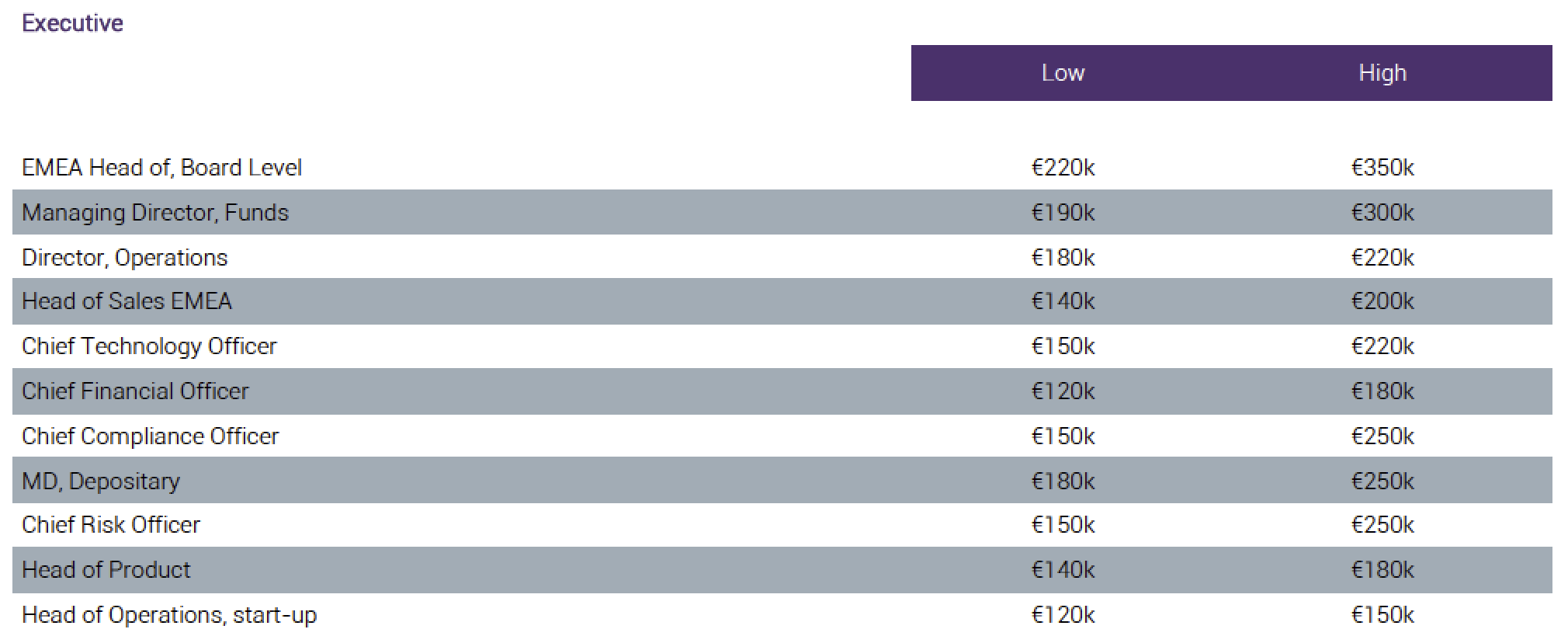

Note: Bonus are based on the size of the organisation, the individual and the role. Executive positions can sometimes be up to 100%.

Your Funds & Investment Management Team

Anne Keys, Joint Managing Partner leads The Panel’s executive search in the Funds and Investment Management sector and is uniquely placed to partner with firms in hiring executives, board members and independent non-executive directors.

Anne Keys, Joint Managing Partner leads The Panel’s executive search in the Funds and Investment Management sector and is uniquely placed to partner with firms in hiring executives, board members and independent non-executive directors.

Anne works with a large number of the investment firms establishing a presence in Ireland following the Brexit vote and has had great success sourcing Country Heads/CEOs, PCF and DP roles for her clients.

Anne’s key differentiator is her extensive network developed over 23 years in recruitment and her technical knowledge of the roles she recruits for, in the funds and investment management space. She provides consultancy advice on the talent landscape, talent availability and is hugely knowledgeable on the sourcing requirements driven by the CBI under CP86.

Anne was instrumental in the set up and launch of 100 Women in Finance in Ireland and is Co-Vice Chair of the steering committee in Dublin. She is driving 100WF workshops for their executive female members, advising them on how to launch their independent non-executive director careers.

Anne has been invited to speak at key industry conferences in Dublin, London and Amsterdam on “CP86 Dear Chair – Getting the plan right”, “The talent landscape in Investment Management sector in Ireland”, “ The War for Talent”, “ The benefits of an international board” and “The benefits of a diverse board”.

She also supports basis.point the Irish Fund industry’s initiative to come together to help make a difference to those in need.

Liam Murphy joined The Panel’s Funds & Investment Management division in July 2013 and has since been promoted consistently within the business to his present role as Associate Director in March 2019.

Liam Murphy joined The Panel’s Funds & Investment Management division in July 2013 and has since been promoted consistently within the business to his present role as Associate Director in March 2019.

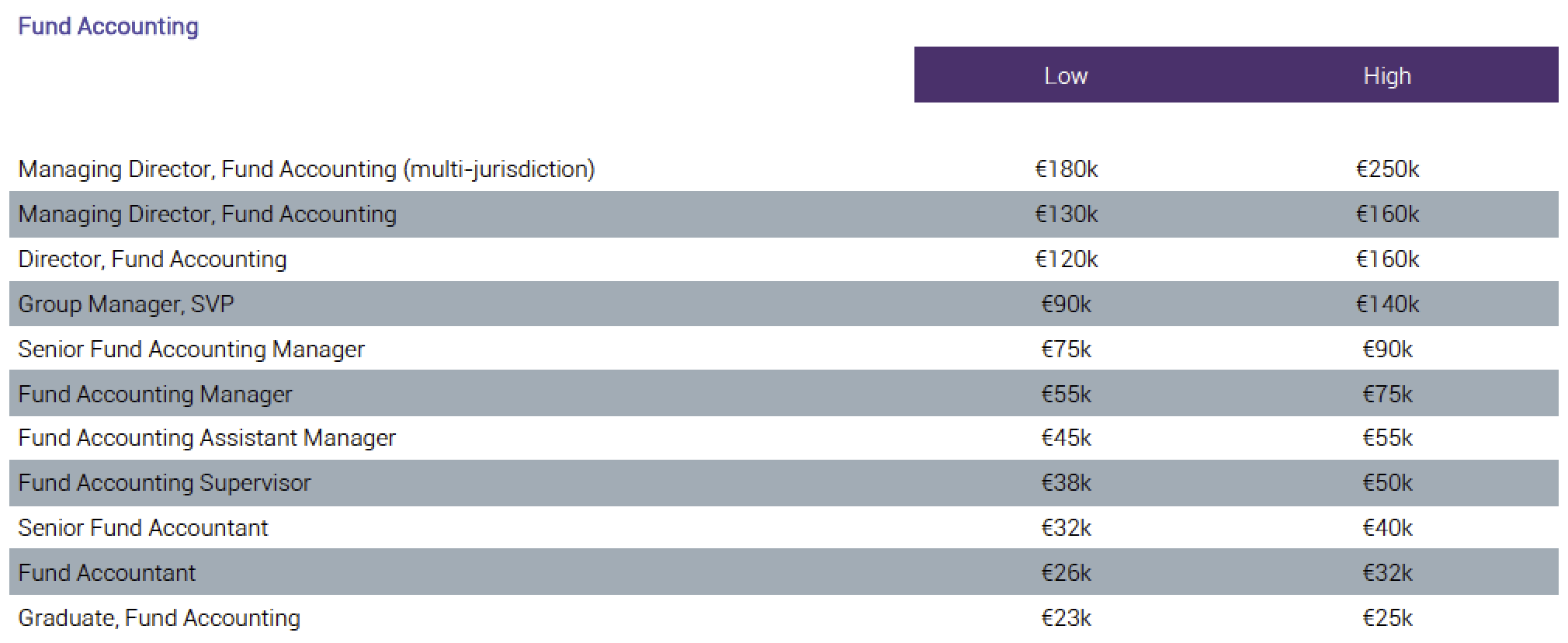

In his role Liam specialises in the recruitment of roles between manager and executive level on behalf of various financial services entities including Asset Managers and Fund Management companies based in Ireland and overseas. Areas Liam recruits for include Transfer Agency, Fund Accounting, Compliance, Trustee, Custody, Middle Office, Risk, Distribution, Regulatory, Depositary Data, Operational Oversight as well as other niche roles.

Liam graduated from the University of Limerick with a BBS in Marketing & Finance (2007). He also holds a ‘Certificate in International Financial Markets’ and a ‘Certificate in Financial Services Modules’ from the Institute of Bankers. He worked for 5 years in the funds industry before joining us.

Finlay Barry is a Senior Manager within The Panel’s Financial Services Department. Finlay specializes in sourcing senior Risk and Compliance professionals for Ireland’s leading wholesale banking and investment management institutions.

Finlay Barry is a Senior Manager within The Panel’s Financial Services Department. Finlay specializes in sourcing senior Risk and Compliance professionals for Ireland’s leading wholesale banking and investment management institutions.

Finlay has a proven track record of placing PCF holders into new and established firms across Ireland and the UK. Finlay works closely with Managing Partner Anne Keys and Partner Alan Bluett.

Finlay has 6 years recruitment experience in a top Irish FS recruitment business. Prior to this he worked in investment operations for a global bank.

Finlay holds a BA in Economics from UCD and a Masters in Strategic Management from Smurfit Business School.

Farah Daoub is a Recruitment Administrator for our Funds & Investment Management and Banking & Treasury practices.

In this role, she supports our Joint Managing Partner Anne Keys and our Banking & Treasury Partner, Alan Bluett, and is responsible for the support of both divisions, sourcing suitable candidates, interview preparations, onboarding processes, reference checking and interacting with clients on behalf of the partners.