EXECUTIVE

ACCOUNTANCY & TAX

BANKING &

TREASURY

ESG &

SUSTAINABILITY

HR & BUSINESS

SUPPORT

accountancy

salary guide 2022

accountancy salary guide 2022

CFOs to Accounts Staff

Industry & Financial Services

Author: Paul McArdle, Joint Managing Partner

Download the 2022 salary guideView all salary guidesoverview

2021 was a fascinating year in the accountancy recruitment market. The year began slowly but started showing signs of recovery from a COVID impacted 2020. The Panel made double the number of accountancy placements in 2021 than 2020 and we are now as busy as ever.

In December 2021 we had our best month of accountancy placements for ten years.

Step change in the market:

Towards the latter end of 2021 we saw a step change in the market. More roles were being registered and candidates had more choice. The newly and recently qualified accountants market has always been robust over the years and COVID accepted, has always been a candidate led market. The candidates at these levels interviewed the clients and could choose where they worked.

The biggest change has been at the more senior levels, right up to CFO levels. Traditionally the higher salary level, the more it was a client led market. Our clients could be very prescriptive with their requirements, particularly around direct sectoral experience. They would have a strong choice of senior candidates to choose from and they could take their time in making an appointment, as the candidates were not moving.

As 2021 went on, this situation changed completely. For the first time in a very long time, the demand for more senior candidates went up and these candidates had roles to choose from in the market. Where previously salaries were being pushed up from the hot demand in the newly and recently qualified accountant market, the salaries at the more senior end were rising now due to increased demand at the financial controller/finance director level.

Bonuses:

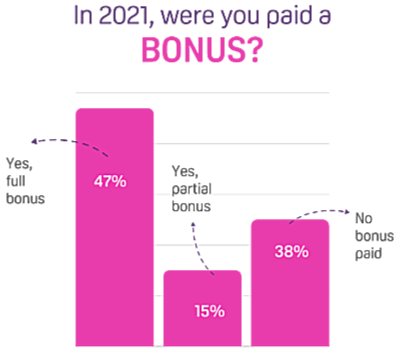

One interesting aspect on salaries in 2021 was the fact that 62% of candidates we surveyed got some or all of their expected bonus. 47% of them got their full bonus, which is a sign of confidence returning to the market.

The client is now the candidate:

Across the board, clients are now realising that they are in fact the candidate and the candidate is the client. Our candidates are now fussier on what they are looking for, and not just from a salary perspective. The biggest change in the market is the requirement from candidates around where they are located for work. Over 50% of our candidates would like the option of hybrid working, this was rarely a part of any conversation pre-COVID.

Clients not only have to be more flexible in the working options they can offer candidates, they need to move much quicker during a recruitment process. The candidates they are interested in now have choice. Clients that offered a more flexible working arrangement and moved quickly were more successful in securing talent. Often these clients had to offer higher salaries than they had intended as salary inflation returned to the senior end of the market.

The return of the counter offer:

The return of the counter offer:

The increased demand for finance talent has seen the return of counter offers. We have had a number of placements fall through at the final stages as the candidates own employer matched or improved on the offer their employee had received.

We also bizarrely had a couple of instances at the reference checking stage where previous employers, finding out their former employees were back on the market, offered them roles!

Remote working:

Another big change in the market is that more clients and candidates are comfortable with remote working. These has led to clients having a bigger pool of potential candidates to choose from as location is no longer a restriction. It has also opened up the market to candidates living away from the main urban areas.

The biggest issue here is around the quality of digital connectivity in the candidate’s homes. Poor connectivity makes remote working untenable.

Part-time:

Another cohort that has returned to the market are the stay at home parents (mainly women) in both full time and part-time roles. The return of more female finance professionals to the market has to be welcomed, many of them getting part-time roles that allow them to facilitate their personal domestic circumstances.

We are seeing the biggest demand for part-time solutions at the accounts level. We also have a sister company, The Agile Executive, that specialises in the placement of part-time CFOs with smaller businesses. Most of their work is done remotely.

2022:

The year has started off as 2021 ended with more demand for finance talent. We surveyed our can-didates for this guide and what was striking is the return of confidence in the market.

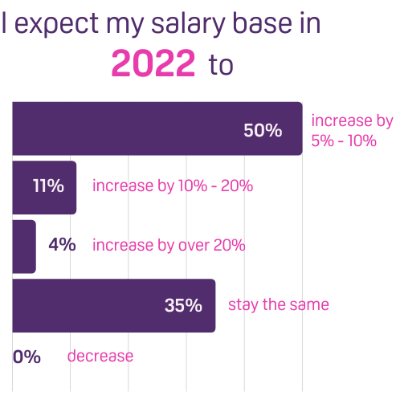

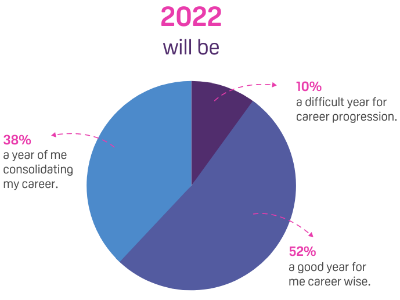

Over half of the candidates surveyed expect 2022 to be a good year for them career wise with one in three of them looking to move companies during the year. A third of the candidates expect their salaries to stay static this year, however over half of them expect a salary increase of up to 10% with one in 10 believing their salaries will increase by more than 10%.

Market Survey 2022

We surveyed accountants and accounts staff for this Salary Guide on topics such as COVID, bonuses and sentiment for 2022. 500 respondents filled out the survey. We were surprised with some of the answers and not with others.

First off, there is an air of optimism regarding salaries in 2022:

35% of respondents expect their salaries to stay the same, however 65% expect to get some increase, with half of the respondents expecting a 5% to 10% increase. We did get a couple of respondents who expect a salary decrease, but they were outliers.

Over half the respondents expect 2022 to be a good year for their careers with just under 40% expecting it to be a year of consolidation. Only one in ten of the respondents are expecting a difficult year, in line with the optimism on salary increases before.

The figures that really surprised us were around bonuses paid in 2021.

Over 60% of respondents got a bonus, just under half of respondents got their full bonus. A significant number – 38% got no bonus, we were expecting that figure to be much higher.

On the effects of COVID, we were surprised with the “upbeat” nature of the responses.

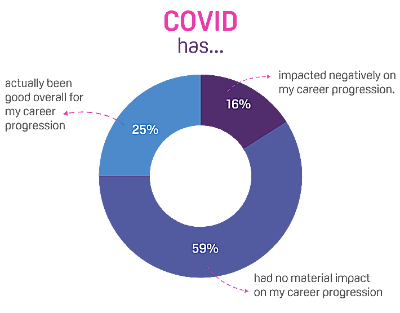

Only 16% felt that COVID had impacted their career progression, a far smaller number than we anticipated. Nearly 60% of respondents stated that COVID had no material impact and one in four felt that COVID was actually good for their career.

Where COVID has had a huge impact is our working environment. In two short years a lifetime of work habits have changed and possibly for good.

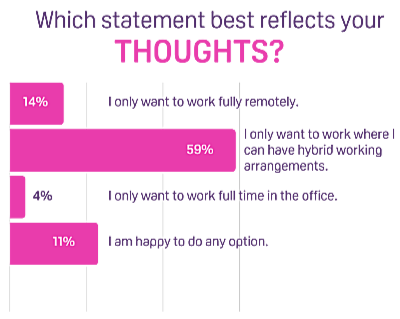

What is striking most about the figures is that less than 5% of respondents want to work in an office full time, this is a huge cultural shift. Close to 60% of respondents prefer a hybrid option with 23% open to all working options. Interestingly 14% of respondents went for the option of fully remote working, a figure we thought would be higher.

When we speak to candidates now, the subject of where they will be located for work is a key part of their decision making process.

Clients who are looking for someone to be in the office full time are finding it particularly hard to attract talent and many have had to adapt and offer hybrid or remote working options.

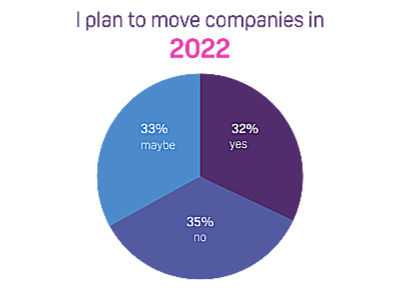

When we asked if the candidate was thinking of moving company in 2022, the responses were evenly divided, roughly a third, a third and a third.

There is a sense that candidates are more curious about potential opportunities elsewhere.

The “maybe” figure is 33%, combining that with the “yes” figure of 32%, means that in effect two out of every three respondents are open to discussing moving companies, a sobering figure for all employers.

We believe there is a pent-up demand for finance talent and candidates are well aware of this. Therefore these figures should not be as much of a surprise as we think.

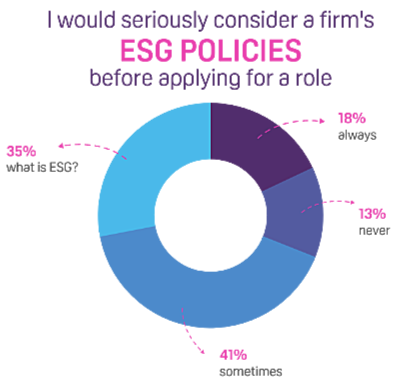

We also asked about ESG (Environment Social and Governance) another hot topic and how relevant respondents felt ESG was in their career choices. Again, we were surprised with the survey results.

Less than one in five of the respondents would look at a potential employers ESG track record and policies, a much lower number than we anticipated. 28% of respondents didn’t know what ESG is and 13% would never consider ESG as a factor in their career decision making process.

However you can see that over half of the respondents (Sometimes – 41% and Always – 18%) do consider ESG and employers need to be cognisant of this. We expect that more candidates will consider ESG as part of their due diligence on prospective employers.

Overall, there is optimism that 2022 will be a good year for accountants and accounts staff alike.

The sentiment is very positive and we expect to see salaries rise, the volume of opportunities for candidates to increase and the war for talent to get that bit harder!

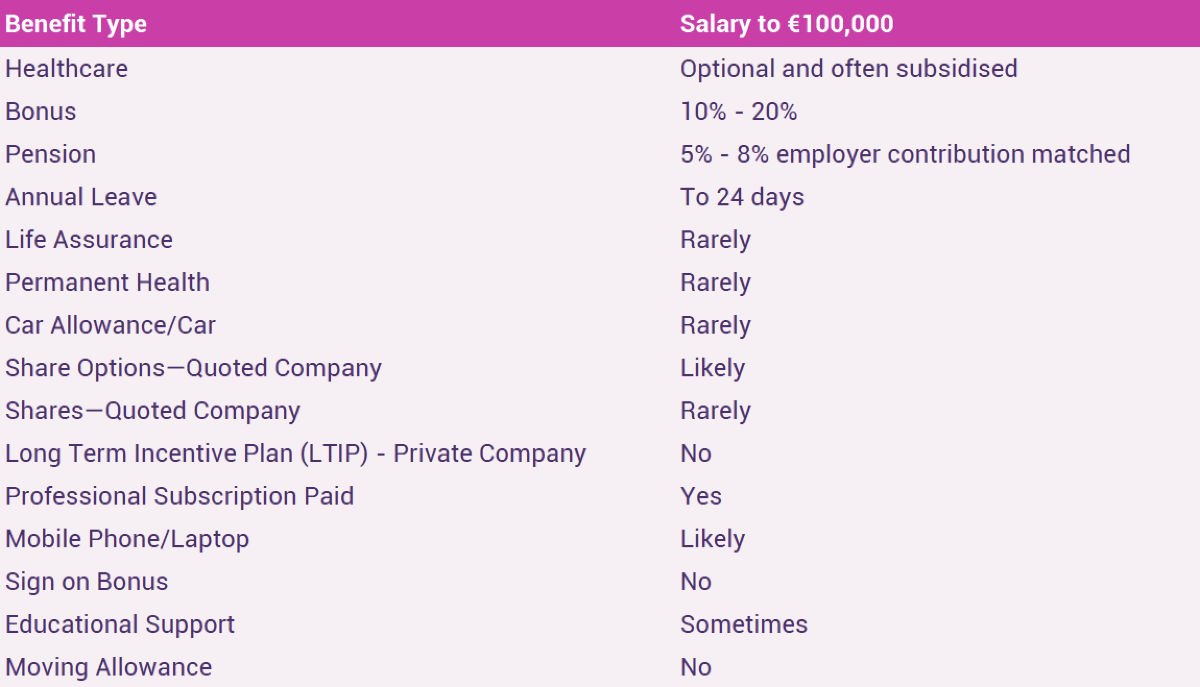

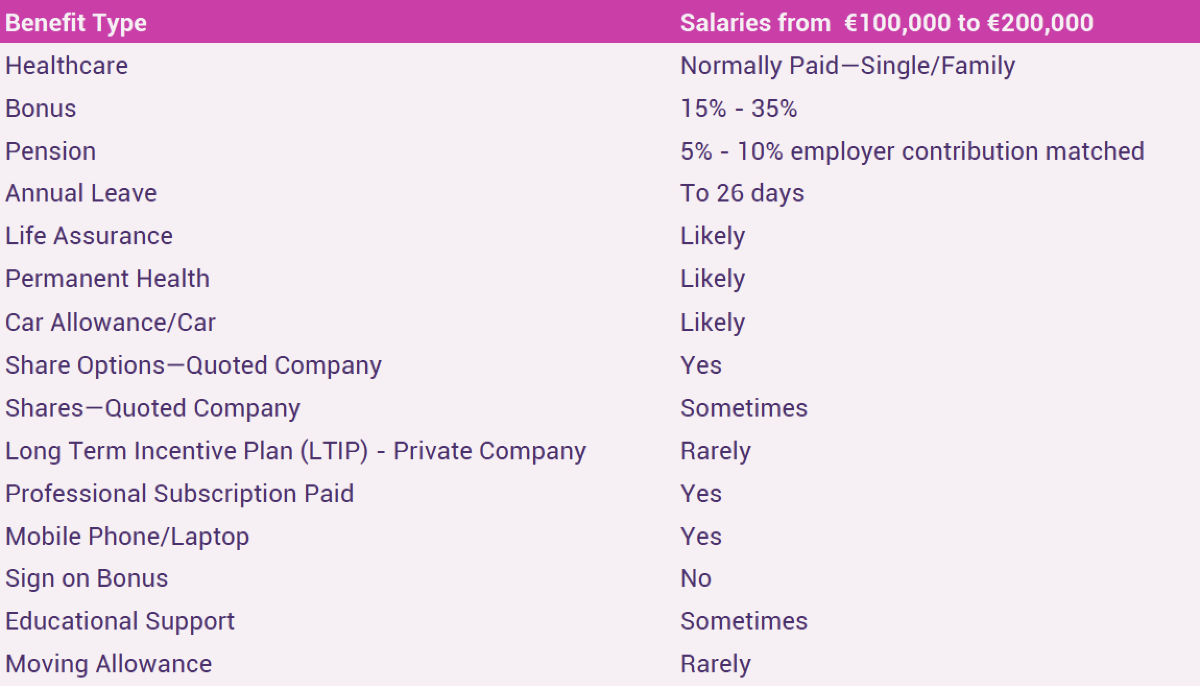

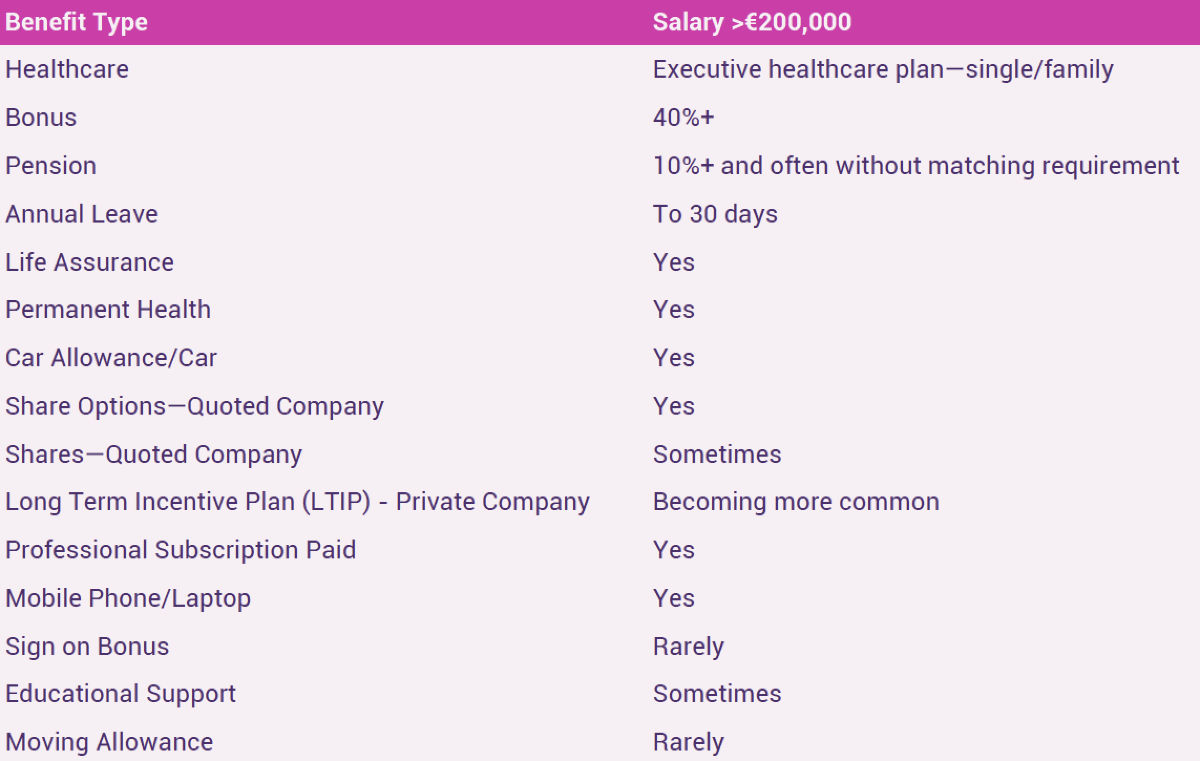

Benefits package

- Share options and LTIPs normally have a vesting period in place.

- A LTIP can be used by a private company to incentivise their “C” suite without having to give equity.

- An increase in paid holidays is a common way for clients to sweeten a salary package.

- Some clients give a fixed amount to their employees in addition to base salary – a flexible benefits package, which they can spend in any way they want to. This replaces all other benefits.

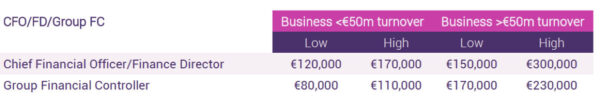

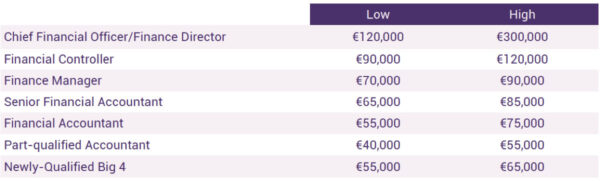

The CFO Market

As stated in our overview, there has been a big uplift in demand for senior finance talent. It should be stated that this big increase in demand is coming from a low base, but it is a material change.

A lot of our recruitment assignments in 2021 were to secure CFO/FDs for private equity backed businesses. These assignments were for businesses that were looking to scale considerably for an eventual liquidity event. In all cases a LTIP (The Long Term Incentive Plan) was part of the salary package.

LTIP:

A LTIP is a mechanism used to reward an employee for reaching a specific goal that leads to an increase in shareholder value. In the assignments The Panel worked on in 2021, the LTIP is to be triggered when a liquidity event take place. The nature of the LTIP is that the bonus is material in nature and only payable if the individual is in the employment of the business at the time the LTIP triggers.

The LTIP is often used by private equity professionals to incentivise a senior management team or as a retention tool to incentivise executive talent to stay with the business. LTIPs are mainly mechanisms used in privately run businesses as publicly quoted businesses can use share awards/share options as a long term incentive.

Choice:

The demand for executive finance talent has seen salary increases returning, often candidates are using external job offers as leverage to get a salary increase from their own employer. Counter offers are back!

This choice of roles also means that clients have to be less prescriptive in their demands. While we are still seeing that specific sectoral experience is an advantage for a candidate to have, it is no longer a pre-requisite like it has been in previous years.

WFH/Hybrid:

Most of our clients are looking for executive finance talent to be office based. They see the CFO/FD hire as crucial and are keen that candidates bed into a new business as soon as they can. Senior candidates are accepting of this and often they negotiate a hybrid option to kick in a few months after they start a role, once they have gotten to know the business better. Our sister company The Agile Executive, is placing part-time CFOs/FDs, most of whom work remotely.

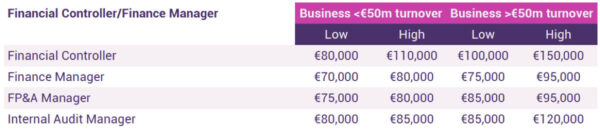

Financial Controller/Finance Manager Market

2020 saw the majority of companies putting their recruitment on hold due to the pandemic but this trend was reversed last year. This led to a huge demand for senior finance professionals across all sectors and has resulted in salaries increasing on average by c.10%.

Counter offers are now becoming the norm due to a shortage of suitably qualified candidates and this has also led to higher salary costs for employers as they move to retain their staff.

After salary, working from home has become one of the key criteria for candidates when they embark on their job search. Companies who do not offer this benefit, risk losing their staff.

Most of our clients are now flexible in this regard and are happy for employees to work from home 2-3 days a week.

2022 is shaping up to be a similar year as 2021. It is very much a candidate driven market now with many job seekers having multiple offers to choose from.

Our advice to clients is to progress your inter-view process quickly to avoid missing out on star candidates. In addition we would recommend for clients to keep in touch with their new starters before they commence to reduce the likelihood of them accepting a counter offer.

Financial Controller/Finance Manager Market

Choice:

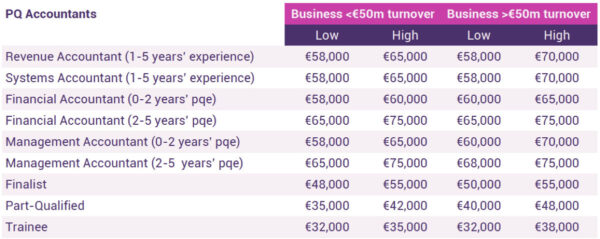

Newly qualified accountants are in higher demand than ever before. Sectors such as Tech, Logistics, Pharma and perhaps surprisingly Retail being remarkably active. This demand has seen salary levels increase by 5%-10% for newly qualified accountants.

For candidates having such choice in the current market, “selling” the role at interview is more important than ever before and certainly career opportunities and flexible work are eclipsing company culture and traditional perks/benefits (albeit still important) in 2022.

With this demand, candidates may have a number of options/offers at any one time therefore an efficient interview process and clarity on timelines are important as candidates withdrawing from the process/declining the job offer because of the hiring process being too long has noticeably increased.

WFH/Hybrid:

Flexibility regarding remote working is consistently the most sought-after benefit at all levels and having the option to remain a remote worker post Covid-19. “Does the position offer remote working?”, is usually one of candidate’s first questions when discussing a new role now.

We are finding clients embracing hybrid teams benefit from a wider talent pool, higher employee morale and better performance. Along with having a significant advantage in hiring and retaining top talent as fully and hybrid working models become a non-negotiable for employees.

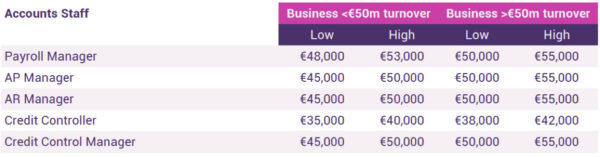

Accounts Staff Market

Choice:

At the accounts staff level, and with workloads in finance teams continuing to grow, there has been a noticeable increase in demand for part-qualified accountants, accounts payable/receivable, and credit control roles.

With this demand, salary levels have reflected this and started to rise steadily, and we expect this to continue. There are other considerations that are proving to be important at this level too such as WFH options, exam support and career progression opportunities once qualified.

Clients are being required to have clarity on career potential and WFH policy at interview stage.

Momentum (if there is a number of rounds) needs to kept swift (within reason), as candidates may have a number of other options/offers on the table at any one time and any unreasonable delay may put a suitable candidate off the position.

WFH/Hybrid:

Most candidates at this level accept that as they join a company/new team being on-site can be more beneficial and productive in terms of getting up to speed and being able to navigate potential early-stage speed bumps more effectively.

However, beyond this onboarding stage, most candidates at this level are seeking a hybrid work model going forward.

From our experience, clients requesting employees to be on-site full-time are severely restricting the talent pool to source from.

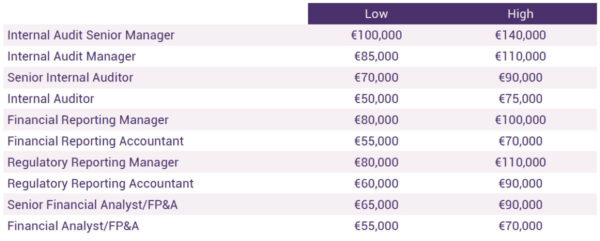

Financial Services Market

The Financial Services sector remained strong through the pandemic, bar the Aviation Leasing sector, which was severely impacted especially in 2020. This led to some of the smaller lessors leaving the market/being acquired. However, in 2021 the better capitalised lessors have been back actively looking for deals and growth is returning.

The domestic banking sector is seeing consolidation as both KBC and Ulster Bank exit, but the pillar banks have very large finance teams, so natural attrition and circulation means there are still plenty of opportunities for finance professionals in this space.

International banks in Ireland are growing their footprints post-Brexit with good demand here for finance staff at all levels. Similarly the proliferation of payments companies has created a large sub section for employment within financial services.

In insurance, our clients in the domestic market were business as usual in terms of their finance recruitment in 2021, while some of our international market facing insurance and reinsurance clients seeing strong growth throughout the year.

The international Funds/Asset Management/Investment Management sectors as well the service companies that support them (corporate services, advisory and the large accountancy practices), have been on a bull run throughout 2021.

Established players are looking to grow with new entrants to the market (Brexit driven or otherwise) all looking for staff to service the ever growing AUM in Ireland.

Some of our clients are more flexible on remote working/hybrid arrangements than others, making it somewhat easier for them to attract talent.

However the increased demand for this talent has meant finance professionals at most levels are seeing strong salary increases (10% to 20%) being offered to entice them to move.

A special mention for those in the regulatory reporting space, this area has been particularly hard to recruit in, those with expert regulatory knowledge have seen the largest rise in salaries.

The Panel

Sustainability

As time moves on the sustainable responsibility of employers are becoming more and more important, therefore we here at The Panel take great pride in doing our best in meeting our target in this area. We take responsibility for our candidates, clients, and every part of our business in order to offer and supply solutions that positively impact those around us.

Knowing that you are partnering with a responsible organisation, should offer you peace of mind.

Read more on our Sustainability Policy here.

Diversity & Inclusion

In The Panel we actively focus on sourcing talent through a D&I lens – we know diverse teams make for better functioning and more collaborative teams.

The Panel and our Managing Partner Anne Keys were instrumental in the setup and launch of 100 Women in Finance in Ireland in 2017 and Anne is currently acting as the Co-Chair for 100 Women In Finance Dublin.

Anne organises and hosts iNED workshops for women. Attendees include C-suite executives considering a career as an iNED and for women who have just moved into this space.

In November 2017, The Panel signed up to the Ibec/30% Club’s “Voluntary Code of Conduct for Recruitment and Executive Search Firms Code”.

This Code recognises the importance of search firms and client organisations working together to deliver change based on four principles:

- Strategy & Goals

- Talent Pipeline

- Prices

- Monitoring & Reporting

What can The Panel help you with?

Regulations – guiding candidates and clients through the Irish regulatory environment.

Market analysis – updating candidates and clients on current trends.

Talent acquisition – for clients we help source the best candidates for the role at hand.

Advice – we provide our candidates and clients with the most up-to-date information available regarding the market, the recruitment processes and the best remunerative options available to both.

Technology & Resources – offering candidates and clients the most up to date in recruitment and AI tech-nology, enabling a quicker and more efficient recruit-ment process from start to finish.

Our Divisions

- Executive, C-suite & iNED

- Accountancy & Tax

- Banking & Treasury

- Funds & Investment Management

- Insurance

- IT & Business Transformation

- Legal & HR

- ESG